The great corporate myth-making machine has been hard at work of late, attempting to create the false impression that U.S. corporations are increasingly uncompetitive with their foreign rivals due to the fact they pay much higher corporate taxes in the U.S. and abroad than their capitalist counterparts.

But that is one of the great myths perpetrated by corporate apologists, pundits and their politician friends. The myth is high in the pantheon of conscious falsifications their marketing machines feed the American public, right up there along with such other false notions that "business tax cuts create jobs," "free trade benefits everyone," "income inequality is due to a worker’s own low productivity contribution," "overpaid public workers are the cause of states’ budget deficits," or that "social security and medicare are going broke."

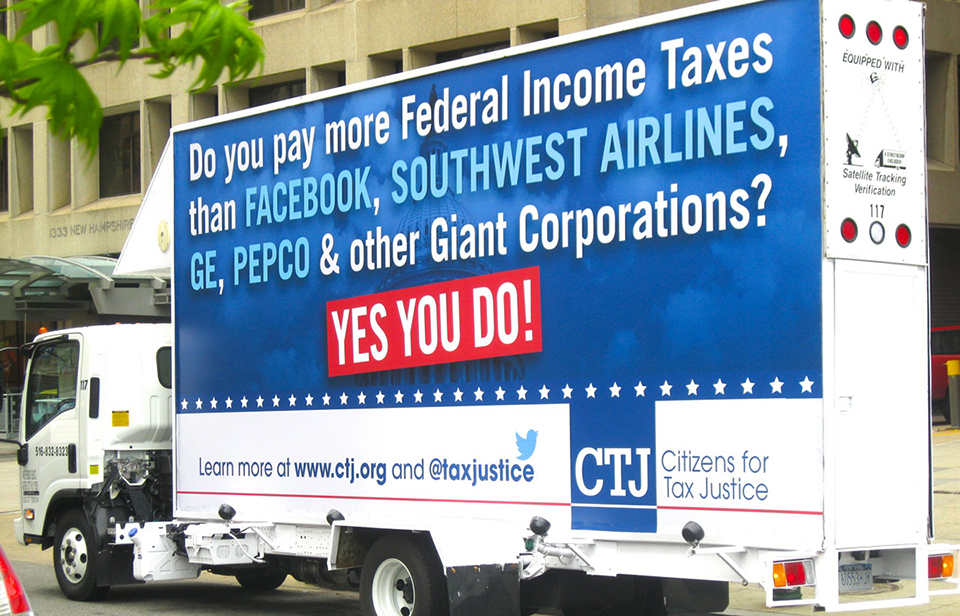

If corporate America can create and sell the idea that they pay more taxes than their offshore capitalist cousins, then they are half way home to getting their paid politicians to provide them still more corporate tax cuts—a proposal by the way that both Republicans and Obama are on record for, in their joint proposal to reduce the top corporate tax rate from 35% to 28% (Obama) or 25% (Republicans).

The message of too high corporate taxes is appearing more frequently nowadays, since actual legislation for big corporate tax cuts is now working its way through Congress. Driving the legislation are Teaparty favorites in the House of Representatives, like David Camp, head of the Ways & Means Committee, and Max Baucus, Democrat in the Senate, who is set to retire in 2014 and wants to give his business buddies yet another big cash freebie (you know Max, the guy who rode herd on that Health Insurance Corporation subsidy bill called Obamacare?).

So it’s time to debunk the "U.S. Corporations Pay Too Much Taxes" (and thus need another tax cut) myth. What follows is the first segment of a longer essay—with tables and graphs—on the same topic that will appear shortly in the December issue of ‘Z’ magazine. More segments of that essay will follow.

U.S. corporations don’t pay the nominal corporate tax rate of 35% today; they pay an effective (i.e. actual) rate of only 12%. The additional effective state-wide corporate income tax they pay amounts to only a 2% or so—not the 10% they claim. And the effective corporate tax on offshore earnings is only another 2.2% or so—not the 20% average they’ll complain.

So the total tax for U.S. corporations is barely 16%—not the 35% plus 10% (state) plus 20% (offshore) nominal tax rate. And however you cut it, the story is the same: U.S. corporations’ share of total federal tax revenues have been in freefall for decades. The share of corporate taxes as a percent of GDP and national income has halved over the decades.

And corporations since 2008 have realized record level profits during the "Obama Recovery"—while their taxes as a percent of profits since 2008 is half that of the average paid as recently as 1987-2007. Okay, more detail on all that in parts 2 and 3 to follow.

For the moment, what all the corporate tax cutting to date has produced is a mountain of corporate cash. U.S. corporations today in fact are sitting on more than $10 trillion in cash.

For example, even the U.S. business press admits today that U.S. multinational corporations have diverted more than $2 trillion to their offshore subsidiaries, to avoid paying the U.S. Corporate Income Tax.

In addition to the $2 trillion now diverted by U.S. multinational corporations offshore, after having paid federal taxes another $1 trillion is now held as cash on hand by the 1,000 largest nonfinancial companies based in the U.S. as of mid-2013, an increase of 61% in the past five years, according to a study by the REL Consulting Group.

For financial companies, deposits in U.S. banks are currently at a record $10.6 trillion, while bank loans outstanding have been declining since 2008 and are now at a record low of $7.58 trillion—thus leaving U.S. banks sitting on a cash hoard of nearly $3 trillion according to the Wall St. Journal. That’s a total of more than $7 trillion so far.

This record after-tax cash exists despite corporations having bought back their stock and paid dividends worth trillions more since 2008. Corporate buybacks of stock since 2009 passed the $1 trillion mark in 2012, according to a survey by Rosenblatt Securities—with projections to increase at an even faster rate of $400-$500 billion more in 2013.

Corporate dividend payouts equaled another $282 billion in 2012 alone, perhaps at least that amount in years prior, and are today projected to exceed $300 billion in 2013. That’s another $2.5 trillion.

Include hundreds of thousands of U.S. corporations and businesses that are not part of the largest 1,000 or who don’t operate offshore—plus cash socked away in depreciation funds and other special funds for all the above—and that comes to at least another $500 billion.

That $10 trillion corporate total, moreover, doesn’t include still further additional dollars that have been spent by U.S. corporations abroad. While business investment in the U.S. has been declining, total U.S. corporate foreign direct investment is estimated at $4.4 trillion in 2012, up from $3 trillion in 2007 and from $1.3 trillion in 2000. So that’s another roughly $1.4 trillion in corporate income committed offshore since the official ‘end’ of the recession in June 2009.

Add all that up and its well more than $10 trillion in buybacks, payouts, and hoarded cash (onshore and offshore) by U.S. corporations since 2009—i.e. during the sub-par economic recovery (for the rest of us) of the past four years. That’s corporate income and cash that has been diverted, hoarded, or otherwise not committed to U.S. real investment, and therefore never contributing to jobs, income creation and consumption in the U.S.

No wonder consumption (70% of the U.S. economy) for the bottom 80% households in the U.S. has been stagnating, stalling, or declining in the U.S. in recent years. No wonder all the U.S. economy can do is create low wage, contingent, service jobs, while more than 20 million are still unemployed and uncounted millions more have left the U.S. labor force altogether. No consumption recovery follows declining U.S. investment, while tens of trillions of dollars go elsewhere or sit on the sidelines.

To summarize, at least as much as $10 trillion—and perhaps approaching $12 trillion—has been taken out, redirected, diverted, or otherwise hoarded by U.S. corporations since the 2008 crash. Keep all that in mind when you next hear politicians from the two wings of the one party system in America—Republicans and Democrats—and their friends in mainstream media trying to justify proposals for still more corporate tax cuts.

Jack Rasmus serves as the Chairman of the Federal Reserve System in the Economy Branch of the Green Shadow Cabinet of the United States.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments