It’s a question which goes to the heart of virtually any discussion about the future and the impact of climate change: how is it possible to maintain or increase energy supplies while at the same time cut back on CO2 emissions?

Faced with this dilemma, there are those who say the only course of action is to do away with the idea of economic growth – an argument that does not go down well in many quarters. But a new study says the world can, in fact, have its cake and eat it – growth can continue and CO2 emissions can be cut.

The study, by the Energy Futures Lab and Grantham Institute of Climate Change at Imperial College, London, says the key is employing technology to radically decarbonise the world’s energy sector: this, say the researchers, can be accomplished with technologies that either currently exist on a commercial scale, have been demonstrated to work or are still awaiting full-scale deployment.

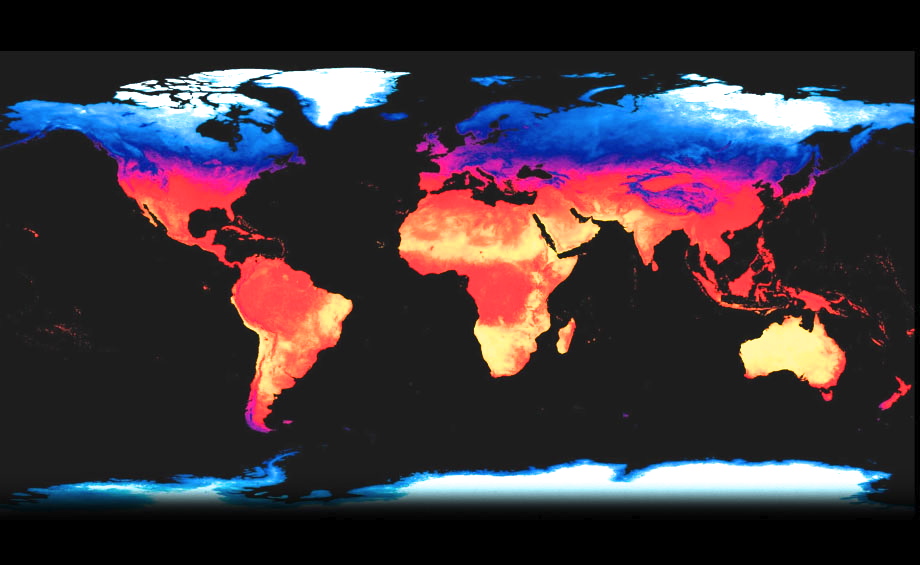

The study states the present position: the world needs to limit the overall global temperature to around 2°C above pre-industrial levels by 2050 in order to avoid the more serious impacts of climate change. That means a wholesale cut in fossil fuel use and a big reduction in CO2 emissions – from around a global total of 31 gigatonnes (Gt) per year at present to about 15 Gt per year in 2050.

Fundamental Importance

The trouble is we are going the wrong way: on present projections – and barring a cataclysmic meltdown of the world economy – fossil fuel consumption will increase by 50% between now and 2050 and CO2 emissions could rise to 50 Gt per year or more. This would result in higher global temperatures and possible runaway climate change.

The study divided the world into ten geographical regions and, in each area, projected both economic output and population growth to 2050. The global population is likely to grow to more than nine billion, say the researchers, while real per capita incomes will almost treble.

Decarbonzsing the world’s electricity generation system is fundamental says the study: the large-scale development and commercial deployment of carbon capture and storage (CCS), biomass, solar, wind and nuclear sources should be high on every government’s agenda.

“…With challenging but feasible penetrations of low-carbon technologies, an energy and industrial system transformation is possible…”, says the study. It focuses on three sectors: industry, buildings and transport.

It says: “…There needs to be a shift towards electrification of industrial manufacturing processes, building heating systems and vehicle propulsion systems.

“A range of technologies will be required to achieve this, including increased penetrations of electric arc furnaces in steelmaking, heat pumps in buildings and battery electric and hybrid vehicles in road transport.

“Considerable investment in developing new technologies, with associated infrastructure, needs to begin now in order to enable the penetrations of these technologies that are required by 2050.”

Achievable Goals

The study admits that all this will be very challenging in technological, operational, social and political terms. For example, achieving targets for bioenergy would require the use of nearly 9% of the world’s total arable and pasture lands.

The goal is achievable – and affordable – says the study. Its analysis indicates the transition to a low carbon energy future would cost about $2 trillion a year by 2050. While that figure might seem large, the researchers point out it would amount to only about one per cent of global gross domestic product, based on projected 2050 GDP figures.

Whether or not the planners and politicians will take heed of the study’s findings is the big question. In 2006 the Stern Review examined the impact of climate change, warning of the escalating costs in economic terms of not taking action to limit greenhouse gas emissions. In May this year CO2 concentrations in the atmosphere reached 400 parts per million, a level generally considered to be the highest for more than four million years.

-

In other reporting on the subject, Jacob Sandry writing on EcoWatch](http://ecowatch.com/2013/5-reasons-solar-beating-fossil-fuels/) lists five reasons that solar energy is already beating fossil fuels:

The solar industry is growing drastically every year, while fossil fuels continue to be phased out. This is why it’s frustrating to hear people say that renewable energy is not ready to compete with fossil fuels as a means to power our country. Here are five reasons why solar is already winning.

1. Jobs

There are more people in the U.S. employed in the solar energy marketplace than mining coal. The banal argument that transitioning to a clean energy economy will cost us jobs is simply false. Solar is growing more than 10 times faster than the American economy.

Solar already employs more than coal, and that gap is widening. In 2012, solar added 14,000 new jobs, up 36 percent from 2010 and the industry will add another 20,000 jobs this year. The fossil fuels industry cut 4,000 jobs last year. So when it comes to employing Americans, solar is winning.

2. Price

Solar panels have a seen a consistent drop in prices over the last three decades, and in the last few years that drop has been meteoric. In the last 35 years prices have gone from $75/watt to around $.75/watt. Since 2008, the cost of coal has risen 13 percent. In some parts of the market, solar has already reached parity with coal.

I’m sure you’ve heard the argument that solar is economically effective only by relying on government subsidies. Currently this may be true, but if solar prices reach Citigroup’s prediction of $.25/watt by 2020, subsidies may not be needed. And then there’s the glaring fact that oil, gas and coal receive subsidies that dwarf those of renewables ($409 billion vs. $60 billion globally).

And that’s ignoring the extra costs that burning fossil fuels impose on the rest of society, that aren’t paid by fossil fuel companies (called externalities by economists). The Harvard Medical School estimates that burning coal in the U.S. costs $500 billion in environmental and health damage (and then there’s, you know, the whole climate change thing). If those costs were taxed onto coal plants, the price of coal would more than double.

3. Capacity

With the cost of solar dropping rapidly, installations are escalating at an exciting rate. Earlier this year, the U.S. became the fourth country to have 10 gigawatts of solar energy capacity, with installations increasing at a rate of 50 percent annually for the last five years, that rate is expected to increase to 80 percent this year.

Two-thirds of global solar capacity has been installed over the last two years. In contrast, 175 coal fired power plants in the U.S. are expected to be shut down over the next five years (more than 10 percent of total capacity). This reflects the rising costs of coal and the implementation of stricter environmental regulations.

4. Investment

While fossil fuels have been an omnipresent part of investment portfolios for decades, their reign may be coming to an end. Recently a number of reports have shed light on an impending carbon bubble. Fossil fuel companies are valued in the market based on their reserves of unburned fuel still in the ground. If international regulations are put in place to prevent atmospheric carbon dioxide levels from rising above 450 ppm (the estimated cap to avoid irreversible climate change), much of the listed reserves couldn’t be used.

This means that many fossil fuel companies are overvalued as they potentially have huge unburnable reserves of fuel. British bank HSBC estimates that once stricter climate regulations are put in place, the value of fossil fuel companies may fall drastically. Already, coal companies have dropped in value 75 percent over the last five years.

Firms like Mercer and WHEB are advising investors to move their investments out of coal and oil and into renewables. Major investors are already making this move. Warren Buffett has invested in one of the largest solar farms in the world and has predicted the end of coal as an American power source.

5. Environmental Impact

Environmental impact should be pretty clear, but here are some interesting impacts of coal extraction and burning that you may not be aware of:

Acid mine drainage and coal sludge pollutes rivers and streams.

Air pollution causes acid rain, smog, respiratory illnesses, cancers and toxins in the environment.

Coal dust from mining causes respiratory illness.

Coal fires in abandoned mines put tons of mercury into the atmosphere every year and account for three percent of global carbon dioxide emissions.

Coal combustion waste is the second largest contributor to landfills after solid waste.

Mountaintop removal coal mining causes flooding, destruction of entire ecosystems and communities, and the release of greenhouse gases.

Emissions of 381,740,601 lbs of toxic carbon dioxide, methane, sulfur dioxide, mercury, radioactive materials and particulate matter annually.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments