On tax day, when millions of American taxpayers and small businesses pay their fair share to support critical public services and the economy, they will also get stuck with a multi-billion dollar tax bill to cover the massive subsidies and tax breaks that benefit the country’s largest employer and richest family.

Walmart is the largest private employer in the United States, with 1.4 million employees. The company, which is number one on the Fortune 500 in 2013 and number two on the Global 500, had $16 billion in profits last year on revenues of $473 billion.

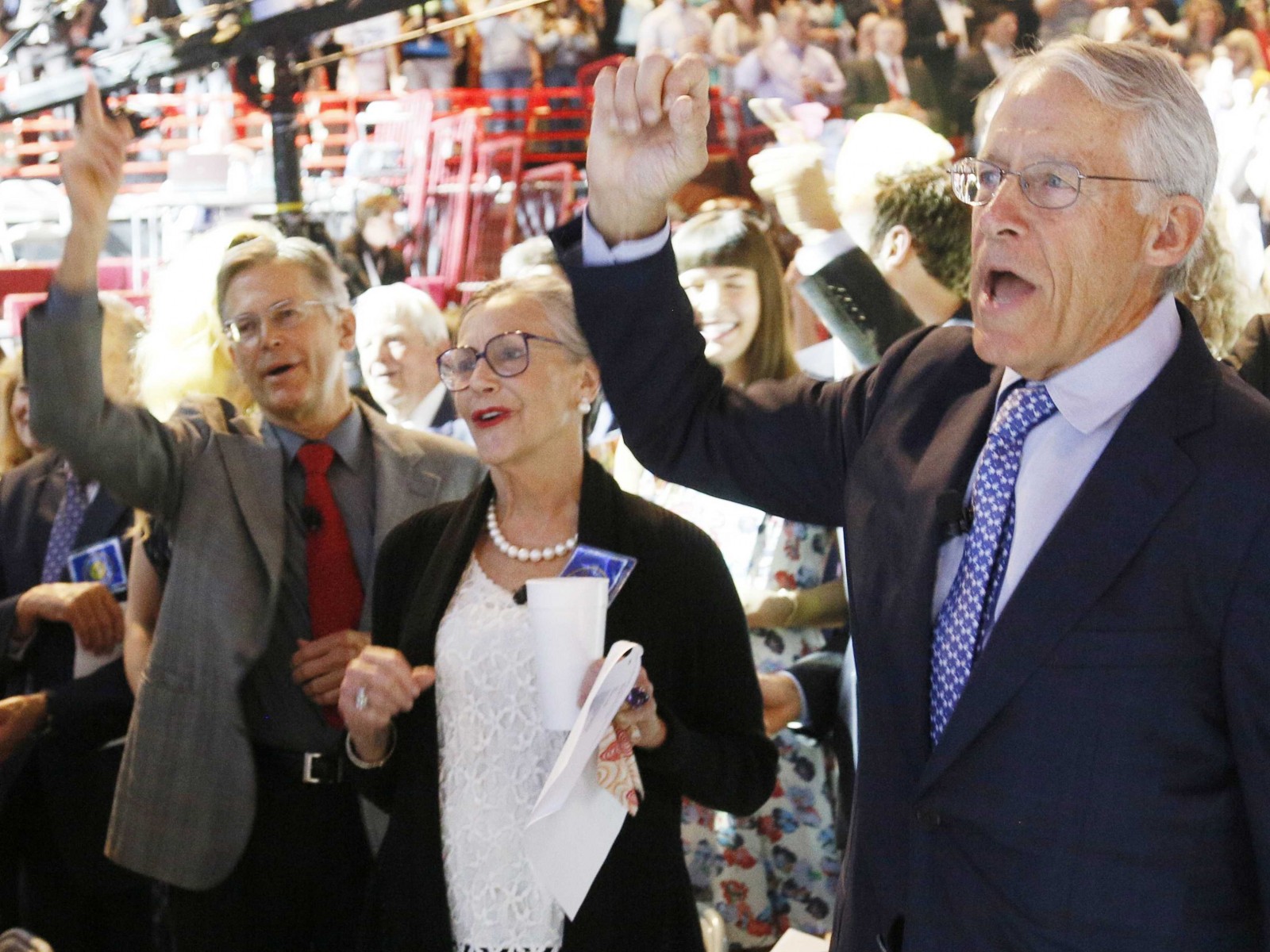

The Walton family, which owns more than 50 percent of Walmart shares, reaps billions in annual dividends from the company. The six Walton heirs are the wealthiest family in America, with a net worth of $148.8 billion. Collectively, these six Waltons have more wealth than 49 million American families combined.

This report finds that the American public is providing enormous tax breaks and tax subsidies to Walmart and the Walton family, further boosting corporate profits and the family’s already massive wealth at everyone else’s expense. Specifically, our analysis shows that:

Walmart and the Walton family receive tax breaks and taxpayer subsidies estimated at more than $7.8 billion a year – that is enough money to hire 105,000 new public school teachers.

The annual subsidies and tax breaks to Walmart and the Waltons include the following:

Walmart receives an estimated $6.2 billion annually in mostly federal taxpayer subsidies. The reason: Walmart pays its employees so little that many of them rely on food stamps, health care and other taxpayer-funded programs.

Walmart avoids an estimated $1 billion in federal taxes each year. The reason: Walmart uses tax breaks and loopholes, including a strategy known as accelerated depreciation that allows it to write off capital investments considerably faster than the assets actually wear out.

The Waltons avoid an estimated $607 million in federal taxes on their Walmart dividends. The reason: income from investments is taxed at a much lower tax rate than income from salaries and wages.

In addition to the $7.8 billion in annual subsidies and tax breaks, the Walton family is avoiding an estimated $3 billion in taxes by using specialized trusts to dodge estate taxes – and this number could increase by tens of billions of dollars.

Walmart also benefits significantly from taxpayer-funded public assistance programs that pump up the retailer’s sales. For example, Walmart had an estimated $13.5 billion in food stamp sales last year.

Polls show that Americans want a tax system that requires large corporations and the wealthy to pay their fair share. This report shows that our current system is anything but fair – rather it provides special treatment to America’s biggest corporations and richest families leaving individual taxpayers and small businesses to pick up the tab.

Walmart, the world’s largest private employer, and the Walton family, which owns a majority of Walmart shares, benefit from an estimated $7.8 billion in annual tax breaks, loopholes, and subsidies. The largest share of this windfall – an estimated $6.2 billion in Walmart on Tax Day subsidies to Walmart – comes in the form of public assistance provided by taxpayers to low-wage Walmart employees.

At the same time, Walmart profited from an estimated $13.5 billion in sales last year to shoppers using SNAP (food stamp) benefits. Meanwhile, the Waltons get more than $600 million annually in savings from the preferential tax rate on their Walmart dividends. And the Waltons are also using special tax trusts to avoid an estimated $3 billion in estate taxes – an amount that could grow by tens of billions of dollars in years to come if the family creates more of these trusts. If, instead of dodging their taxes Walmart and the Waltons paid their fair share, the increased revenues could be used to fund vital public services and reduce the deficit.

Go here to view the full report.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments