When the Royal Dutch Shell Kulluk rig got stuck on the rocky shores of Alaska on New Year’s Eve, the people of that state paid close attention. Not just because they worried about the potential for another environmental disaster in their backyard, but because they pay close to attention to their state’s oil industry in general since they each make a lot of money off of it.

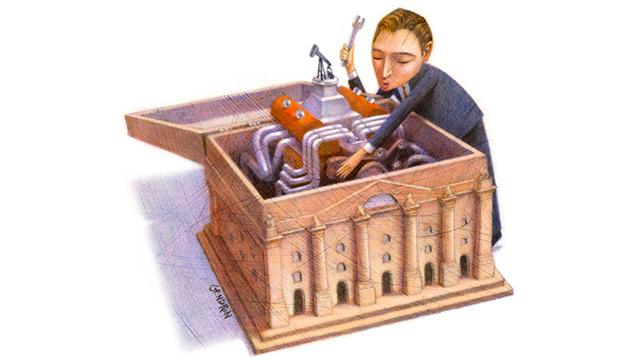

Alaska is unique in that it has something called the Alaska Permanent Fund. Believing that all residents of the state should profit off the resources that are naturally below their feet, Alaska takes the money that big oil corporations pay them in oil leases and royalties, invests that money, and then distributes the returns on those investments to each and every resident of the state.

It works out to between $1,000 and $2,000 dollars for every man, woman, and child in Alaska every single year. So if you’re a husband and wife with two kids, you could earn as much as $8,000 at the end of the year – and that’s not pocket change for a working family trying to make it by during the Great Republican Recession.

Thanks to this supplemental income to each resident of Alaska, the state enjoys the third highest median income in the nation, and is also the second most equal state in the nation.

It’s a system that works, and it’s been embraced by both Democrats and Republicans – even Sarah Palin.

So why not apply it to the rest of the country?

In fact, it is already applied to the rest of the country, but only enjoyed by the billionaire class. Right now our entire economic model, largely controlled by this billionaire class, depends on enriching the lives of shareholders and business owners – but not average working class Americans.

From Wall Street to Big Oil to the for-profit health insurance industry, business decisions are geared to increase the wealth of shareholders. Take a gander at the Forbes 400 richest Americans list and you’ll see a slew of billionaires who collect most of their money in the form of non-labor, dividend income from things they “own” like businesses, land, and infrastructure.

Paris Hilton collects a steady stream of dividend checks from her family’s hotel business. The Koch brothers get their regular checks in the mail courtesy of the massive energy conglomerate their dad built up known as Koch Industries. Mitt Romney continues to collect his checks from Bain Capital.

It’s good to be a shareholder or corporate owner in capitalist America. And that’s all well and good.

But aren’t we all shareholders in our commons just like Alaskans? And being such, shouldn’t we collect dividends every time our commons turn profits for others just like Alaskans?

In Alaska, the money oil corporations pay to lease and extract oil on public lands is distributed to all Alaskans equally. So, nationwide, all the money oil corporations pay to lease and extract oil on public lands could be distributed to all Americans equally, too.

In 2007, the U.S. government collected $9 billion in royalty payments from Big Oil on just the drilling done in the Gulf of Mexico.

In reality, we taxpayers should have collected a lot more, but the U.S. ranks 93rd in the world in how much revenue it collects from oil and gas extraction compared to the profits these industries enjoy. That has something to do with Ronald Reagan. Between 1954 and 1983 the average lease for federal land was $2,224 per acre. But after Reagan, between 1983 and 2008, the average lease was just $263 an acre. Why this happened is the topic of another article.

But still, $9 billion in royalties from just the Gulf of Mexico is a considerable chunk of change. And if we were to distribute that money equally to all Americans, as they do in Alaska, then it works out to about $30 a person. Not too much money, but when you throw in the leases and royalties paid everywhere else around the nation for oil, gas, and coal – from the East coast drilling platforms, to the fracking wells and coal mines in Appalachia, to the oil derricks in the Midwest and Texas, we’re talking serious money.

Not only that, think of how much money is put into our common military to defend the interests of Big Oil abroad to make sure the shipping lanes stay open and the oil spigot keeps flowing. Big Oil should contribute a small fee for this service, which can also be added to this common Permanent Fund to be shared by all Americans.

And what about making Big Oil pay for their pollution of the commons? A cap-and-trade system, which forces polluters to pay for how much carbon they dump into the atmosphere, is a good start and could raise even more money for our commons Permanent Fund to be shared by all of us.

The point is, our commons belong to all of us and should be enriching all of us, and not just the billionaires who’ve put a flag in the ground.

And it shouldn’t stop at just oil.

Wall Street relies heavily on the commons, too. Our markers are regulated by common government, enforced through common courts, and fueled by workers who were educated in our commons.

How about a small financial transaction tax on every single trade – just a fraction of a penny – so that “we the shareholders” in this nation also see the gains from a booming market?

Or better yet, as entrepreneur and defender of the commons, Peter Barnes, proposes, we should all get a cut every time a company goes private. Barnes argues, “When a company like Facebook or Google goes public, its value rises dramatically…Experts call this a ‘liquidity premium,’ and it’s generated not by the company but by society. This socially created wealth now flows mostly to a small number of Americans…Let’s say we required public companies to deposit 1 percent of their shares in the [common fund] for ten years, up to a total of 10 percent. In due time, the [common fund] would have a diversified portfolio worth trillions of dollars.”

Now consider the enormous profits that radio, television, and entertainment companies receive by using our common air and infrastructure and our common copyright laws for basically no charge. They, too, should be paying into the common fund.

Add together all of these “rents” for using our commons, and “we the people” have a raised quite a bit of money for our common Permanent Fund that could go a long way to supplementing the annual incomes of millions of Americans who desperately need a bit more cash.

Somehow, as capitalism was left to run amok in America over the last few decades, we forgot the important role our commons can play in enriching all of our lives. Rather than billionaire CEOs paying us to use our commons, pollute our air and water, dictate our military missions, exploit our markets, and hijack our radio and TV airwaves, it’s all been flipped on its head and we end up paying them. We give them subsidies, generous tax breaks, free usage, and no requirement that they have to share any of the wealth our commons have produced for them with the rest of us who actually own those commons.

So in the end, they make billions off what should belong to all of us while we make squat. This makes no sense. And with pressing concerns about wealth inequality, economic insecurity, and environmental disasters, we need to move away from this corporate rentier-model, and embrace a new universal shareholder model.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments