New York Attorney General Eric Schneiderman filed a lawsuit made up of years-old evidence against JPMorgan Chase, over deceptive practices related to the sale of $87 billion in Bear Stearns mortgage-backed securities at the height of the housing bubble. The lawsuit is closely modeled after one brought against the same defendants by the mortgage bond insurer Ambac, a suit written by a current Executive Deputy Attorney General for Economic Justice in Schneiderman’s office.

The lawsuit only uses state and not federal law, and seems to have been borne of little if any new investigation, though the New York AG’s office claims to have brought the lawsuit “under the aegis” of the Residential Mortgage Backed Securities working group, the task force inaugurated in January to probe securitization fraud in the banking industry before the financial crisis. This is the first suit said to be from the RMBS working group.

But most of the evidence and legal theories in the case come from investigations and suits going back several years, and there’s no reason it couldn’t have been filed at that time. As the relevant statute of limitations under New York’s Martin Act (which has a lower burden of proof, as it does not require demonstrating intent to defraud, only that the fraud occurred) is six years, this will only encompass fraud from late 2006 and 2007, the last vestiges of the housing bubble. This delay in bringing the case cost tens of billions of potential exposure for JPMorgan Chase. And more than anything, the lack of federal participation in the suit shows that the federal agencies involved in the task force are simply disinterested in prosecution, forcing Schneiderman to cobble together an off-the-shelf suit from other sources to make it look like this move against the banks represents anything real. The timing, one month before voters go to the polls in the Presidential election, is similarly obvious.

You can read the 31-page complaint against JPM, Bear Stearns and their mortgage broker EMC Mortgage here. This is a pretty straight securities fraud case. Bear Stearns (bought by JPMorgan Chase in 2008) stands accused of creating and selling mortgage backed securities to investors that contained multiple defects, mostly from faulty underwriting that did not follow the prescribed procedures, and deliberately so. Bear forced the underwriters to cut corners by speeding up the volume of loans churning through the system; one underwriter reported being asked to finish 1,594 loans in five days.

Bear made commitments to its investors that they studiously evaluated all the loans they packaged into the pools that made up the mortgage backed securities. However, they did not evaluate the loans sufficiently, and when they did subject them to limited reviews from third-party due diligence specialists, the reviewers turned up multiple problems. Bear did not inform investors of these defects, which were massive: in one study by the FHFA, 523 out of 535 loans studies did not meet the underwriting standards. This all violates the representations and warranties that they made to investors about their responsibility to deliver loans into the MBS that went through rigorous underwriting.

The kicker is that Bear instituted a post-purchase quality control process, which also turned up defects, including loans that very quickly went into early payment defaults (EPDs) within the first 30-90 days. Bear was responsible for taking these EPDs out of the securitization pools, but they didn’t. They actually entered into secret settlements with the originators of the loans, where the originators would pay to repurchase the loans, at a fraction of the price. And Bear kept the money, $1.9 billion in all, despite being contractually obligated to turn that money over to the investors.

It all sounds very shady. It should also all sound very familiar. This is precisely the kind of case that investors in mortgage backed securities and bond insurers who participated in the deals have been filing for some time. Many of those cases are still active. One, from the mortgage bond insurer Ambac, covers the exact same territory as it relates to JPMorgan Chase, Bear Stearns and EMC. In fact, much of the same evidence from the Ambac case appears in this filing by the New York AG.

Among the allegations are that Bear Stearns (now JP Morgan Securities) profited by obtaining settlements from certain lenders that sold the bank defective loans, while at the same time denying repurchase requests from investors and insurers based on the same loans and the same deficiencies (thereby “double-dipping” on these loans) … and that Bear ignored its own due diligence findings on loan deficiencies, lied to rating agencies about this data, and then went ahead and securitized these loans, anyway [...] This is another great story from The Atlantic, which has been following the news of whistleblowers within EMC since May of 2010, discussing some of the colorful emails obtained from Bear Stearns execs, including one from Bear deal manager Nicolas Smith on August 11th, 2006 to Keith Lind, a Managing Director on the trading desk, referring to a particular bond, SACO 2006-8, as “SACK OF SHIT [2006-]8″ and saying, “I hope your [sic] making a lot of money off this trade.”

The “SACK OF SHIT” email appears on page 11 of the New York AG complaint. In addition, most of the information brought into the lawsuit from the third party due diligence specialist, Clayton Holdings, was made public in late 2010 by the Financial Crisis Inquiry Commission, and also comes out of an cooperation agreement between Clayton and former NY AG Andrew Cuomo, from 2008. The Ambac suit, still active, was unsealed in January 2011, but was an active case dating back to 2008.

There’s a good reason why the Ambac suit is the model for this case. Check out this filing in the Ambac case from January 2011. A team of lawyers from the firm Patterson Belknap Webb and Tyler filed the suit for Ambac, including a woman named Karla Sanchez. In December 2010, after Schneiderman won election as New York Attorney General, Sanchez left Patterson Belknap Webb and Tyler to join Schneiderman’s office as Executive Deputy Attorney General of Economic Justice. One of her main responsibilities is Consumer Frauds.

Sources tell me that Sanchez recused herself from the type of cases she worked on at PBWT, and then at some point un-recused herself. She is not the attorney of record in the suit, and I talked this over with some lawyers who do not necessarily see a conflict of interest here. JPMorgan Chase may make the argument that Schneiderman’s office is seeking to advance a private action that one of their staff wrote, however.

The larger point is this. Not only does there seem to be no new evidence or investigations or legal theories in this case, but the bulk of it was copied off a separate case filed by someone in Schneiderman’s office years ago. Gretchen Morgenson says that the subpoenas in the case all came from Schneiderman’s office in April 2011, long before the RMBS working group ever existed. The Justice Department will apparently try to take some credit for interviewing Clayton Holdings employees in the case, but again, the Clayton Holdings element of this case has been public knowledge through the FCIC and Cuomo’s time as AG going back many years. And if DoJ was so helpful, why didn’t they bring any charges? No federal charges were filed in this case, which represents fairly obvious federal securities fraud. And they have longer statutes of limitations available to them, meaning they would be able to sue for more money, since the cutoff would not be October 2006 but much further back.

Nothing here leads me to believe that the task force played any meaningful role. Schneiderman, getting antsy with just a month to go until the election, took a case off his shelf he had been working on, thanks to his deputy, from the moment he got into the AG’s office. And the evidence that he threw it together quickly comes from the fact that he got the name of Bear Stearns’ auditor wrong in the filing. Bad lawyering.

And just because a suit gets filed, doesn’t mean it will lead to anything approaching accountability. The suit is purely civil and does not quantify damages; all it says is that investors lost $22.5 billion on the bad securities in the time frame under the Martin Act’s statute of limitations, from late 2006 to 2007. And Schneiderman’s track record is weak. He filed suit against MERS and the banks who used it in January 2012, and two months later settled for an almost meaningless $25 million. While Schneiderman claimed that the settlement was only partial, we never heard anything about it again.

Schneiderman’s office promises similar suits against “other sponsors and underwriters.” But the clock is ticking, of course. And if the point is to secure more relief for homeowners, as Schneiderman has said, a case about fraud against investors seems like a terrible way to go about it. Why should investors be happy that a suit about them getting ripped off will lead to a settlement for homeowners and not them?

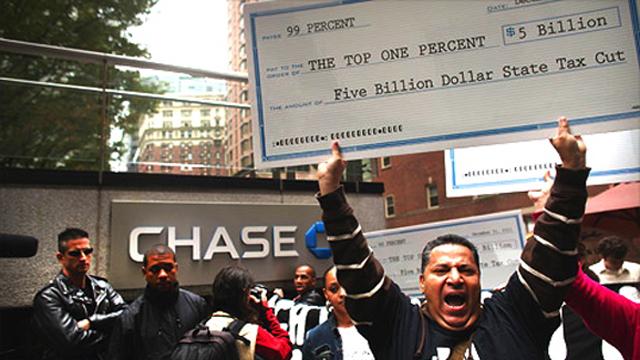

Overall, this looks like a belated PR effort, dumped before the election, to reinforce a new get-tough attitude against the big banks. The bond insurers and investors’ lawyers welcomed the case as a validation of their efforts, however. So at least that’s something.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments