Conservatives force the deficit issue, ignoring job creation, and insisting that tax increases on the rich wouldn't generate enough revenue to balance the budget. They're way off. But it takes a little arithmetic to put it all together. In the following analysis, data has been taken from a variety of sources, some of which may overlap or slightly disagree, but all of which lead to the conclusion that withheld revenue, not excessive spending, is the problem.

1.Individual and small business tax avoidance costs us $450 billion.

The IRS estimates that 17 percent of taxes owed were not paid, leaving an underpayment of $450 billion. In way of confirmation, an independent review of IRS data reveals that the richest 10 percent of Americans paid less than 19% on $3.8 trillion of income in 2006, nearly $450 billion short of a more legitimate 30% tax rate. It has also been estimated that two-thirds of the annual $1.3 trillion in "tax expenditures" (tax subsidies from special deductions, exemptions, exclusions, credits, capital gains, and loopholes) goes to the top quintile of taxpayers. Based on IRS apportionments, this calculates out to more than $450 billion for the richest 10 percent of Americans.

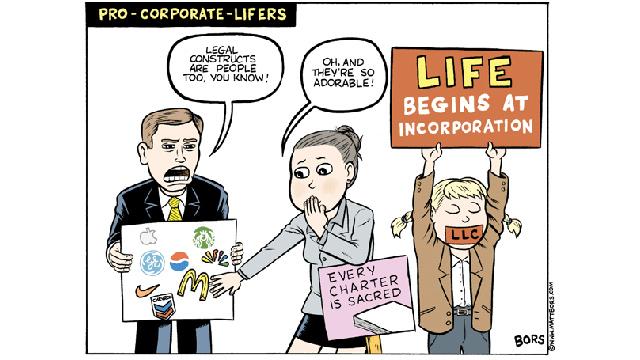

2.Corporate tax avoidance is between $250 billion and $500 billion.

There are numerous examples of tax avoidance by the big companies, but the most outrageous fact may be that corporations decided to drastically cut their tax rates after the start of the recession. After paying an average of 22.5% from 1987 to 2008, they've paid an annual rate of 10% since. This represents a sudden $250 billion annual loss in taxes. Worse yet, it's a $500 billion shortfall from the 35% statutory corporate tax rate.

3.Tax haven losses are at least $337 billion.

The Tax Justice Network estimated in 2011 that $337 billion is lost to the U.S. every year in tax haven abuse. It might be more. A recent report placed total hidden offshore assets at somewhere between $21 trillion and $32 trillion. Using the lesser $21 trillion figure, and considering that about 40% of the world's Ultra High Net Worth Individuals are Americans, at least $8.4 trillion of untaxed revenue sits overseas.

4.That's enough to pay off a trillion dollar deficit. Reasonable tax changes could pay it off a second time:

(a) A non-regressive payroll tax could produce $150 billion in revenue.

Get ready for some math. The richest 10% made about $3.84 trillion in 2006. A $110,000 salary, which is roughly the cutoff point for payroll tax deductions, is also the approximate minimum income for the richest 10%. A 6.2% tax paid on $1.43 trillion ($110,000 times 13 million payees) is about $90 billion. The lost taxes on the remaining $2.41 trillion come to about $150 billion.

(b) A minimal estate tax brings in another $100 billion.

The 2009 estate tax, designed to impact only the tiny percentage of Americans with multi-million dollar estates that have never been taxed, returns about $100 billion per year.

(c) A financial transaction tax (FTT): up to $500 billion.

The Bank for International Settlements reported in 2008 that annual trading in derivatives had surpassed $1.14 quadrillion (a thousand trillion dollars!). The Chicago Mercantile Exchange handles about 3 billion annual contracts worth well over 1 quadrillion dollars. One-tenth of one percent of a quadrillion dollars could pay off the deficit on its own.

More conservative estimates by the Center for Economic and Policy Research and the Chicago Political Economy Group suggest FTT revenues of a half-trillion dollars annually.

Add it all up, and we've paid off the deficit, almost twice. More importantly, the avoided taxes and a few other sensible taxes could provide sufficient revenue for job stimulus without cutting the hard-earned benefits of middle-class Americans.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments