As Congress again fails to prevent the doubling of student loan interest rates to 6.8% (nine times the 0.75% rate paid by big banks), Occupy Museums, a group of artists and activists from the Occupy movement, are calling on deans of U.S. art schools to be transparent with their students about the risks of student loans. In an open letter published this week and sent via email and post nationwide, the group asks deans to:

“Begin a process of transparency in your art institution: educate your students about the realities of debt, and disclose the relationships between your board members and predatory lenders.”

In the letter, Occupy Museums invites deans to support a new art market mutual aid model called DebtFair, which aims to bail their students out of debt.

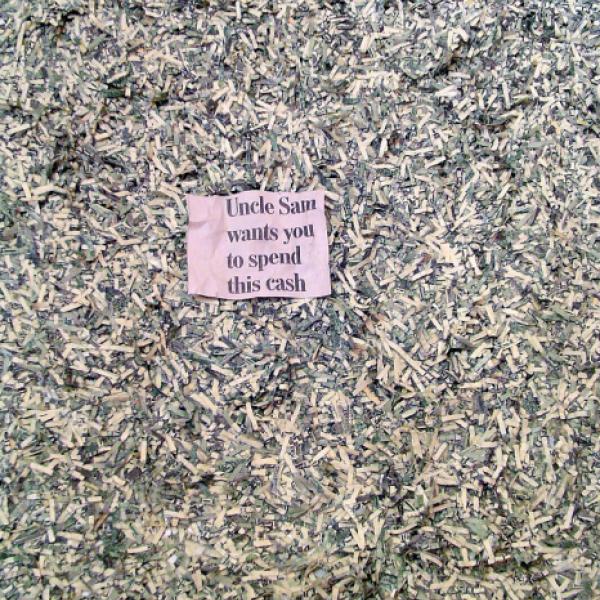

“DebtFair is a series of experimental market-actions that highlight the corrosion of culture through the economic trap of debt,” says organizer and Occupy Museums member Imani Brown. “We are calling on all elements of the art world to recognize the toxicity of our generation’s ballooning debt to our future prospects, as people and as artists. DebtFair is about building solutions together in the face of our government’s failures.”

DebtFair proposes a novel way of viewing and exchanging art, juxtaposing the artists’ economic realities alongside images of their work. On DebtFair’s website, visitors access art images by first reading and clicking on an artist’s debt confessional. “We are looking into the connections between visual culture and debt,” says organizer Tal Beery, “and the website is a growing interactive database of these connections.” DebtFair also plans to host a bailout market where artists will exchange artwork for checks made out to their lending banks.

“The top of the art market is booming, but culture is a fragile ecosystem and the roots are rotting,” adds organizer Noah Fischer. “We know the current model is unsustainable and we need art schools and artists alike to put their influence and resources behind projects that aim for alternatives.”

“DebtFair is acting as a whistleblower in relation to the student debt crisis,” concludes Meredith Degyansky. “At its core, it’s about building a solidarity network in the arts.”

The New York-based group is planning an artists meet-up on August 11 at Abrons Art Center for artists and art lovers to connect around shared economic realities and help develop this new model. More information can be found on www.debtfair.org.

Open Letter to the Deans of Art Programs on the Occasion of the “Fix” of Student Loan Interest Rates

Dear Dean ______,

The educational product you currently offer is misleading, and it’s having a toxic effect on our culture in the form of debt.

Your university’s degrees feed on artists' aspirations and promise a return of professional advancements such as high-end sales, prestigious galleries and academic careers. Yet these opportunities rest in increasingly fewer hands, and the mechanisms of privilege are ignored. The 99% of us either balk at the financial risk of pursuing higher art education, or will spend our entire lives struggling to pay off our loans. We are forced to push our art practice aside to work long hours at unsatisfying jobs that enable us to keep pace with climbing interest payments. This system resembles indentured servitude where the few capitalize on the labor of the many. But models do exist where the value of culture is shared.

Occupy Museums has launched DebtFair, a series of experimental market-actions to address the debt crisis in the arts. DebtFair encourages solidarity rather than competition among artists. It asks participating artists to be transparent about their debt and economic reality, and asks collectors to help sustain culture rather than use it as a tool for speculation. We need models like DebtFair to heal the untenable situation caused by your institutions.

Why are we, as cultural producers, encouraged to contribute to a luxury market for the few at the expense of the many? How could our nation spend more money per year on prisons than on education? What kind of culture are we building for the future?

These are not abstract questions. Tomorrow, Congress will attempt a “fix” to prevent a doubling of student loan interest rates. While students are praying that their rates remain at 3.4%, big banks continue to borrow from our government at 0.75%. The toxic equation of a doubling of interest rates will allow them to steal $37 billion annually from students. But even if the doubling is prevented, the status quo is a crisis for artists and for art education.

We are reaching out to you as a potential ally. You, as [TITLE] of [SCHOOL] are inseparable from this crisis and can be instrumental to its resolution. Ignoring this problem is no longer an option. We invite you to support realistic alternatives. We are calling on you to:

-

Begin a process of transparency in your art institution: educate your students about the realities of debt, and disclose the relationships between your board members and predatory lenders.

-

Encourage your president and board to freeze tuition rates.

-

Lend your support to DebtFair (www.debtfair.org) which aims to bail your students out of debt and attend the meetup and discussion at Abrons Art Center in New York in early August. You will be receiving an additional invitation about this event. Your presence will help to initiate a mutual aid movement to bail artists out of debt.

Enough is enough. We need a cultural bailout in the face of a student debt crisis.

Sincerely,

Occupy Museums

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments