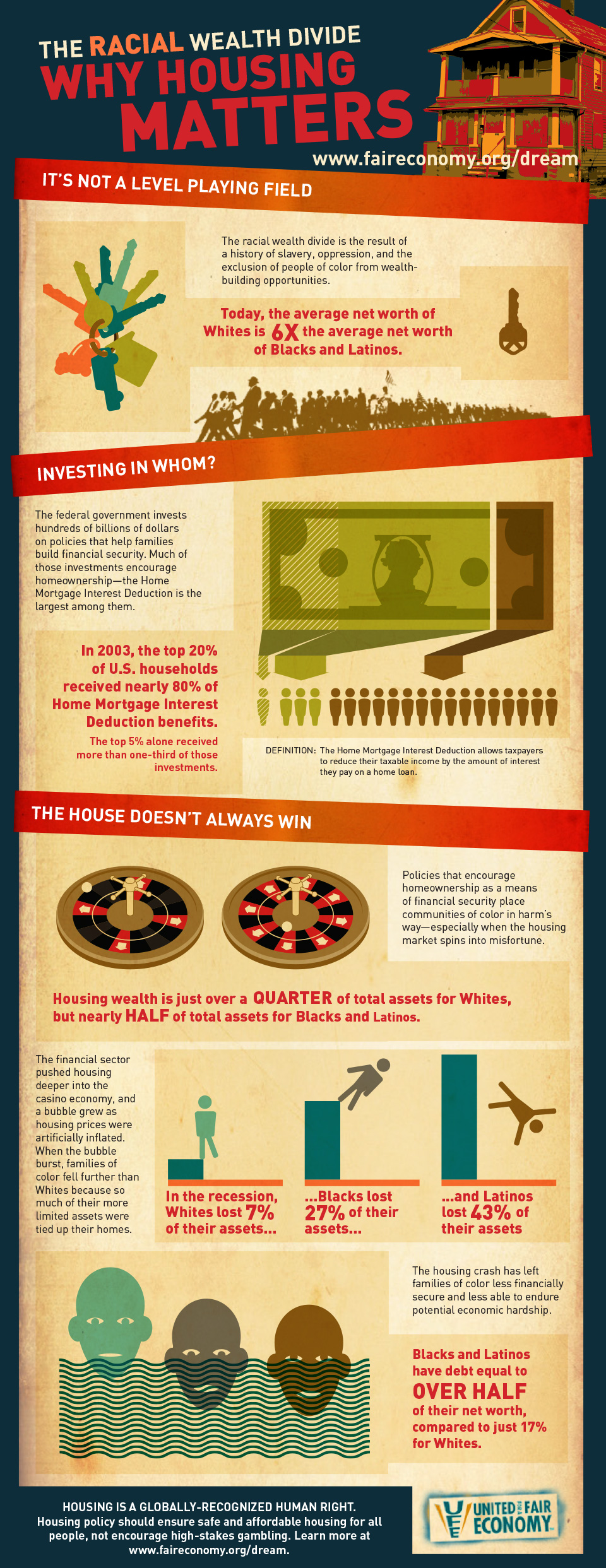

Housing, a cornerstone of the "American Dream," is the largest form of privately wealth held by families across the United States. This infographic draws attention to the intersection of housing as both a globally-recognized human right and as a commodity in a global stock market controlled by the wealthy. We urge readers to acknowledge the history behind the long-standing racial wealth divide and to consider the interplay between federal housing policies and risky financial practices and their impacts on the divide.

We are releasing this infographic just days after Duke University released a new study, which found that Black and Latino homebuyers arepaying more for housing than whites. Earlier this year, shortly after the release of UFE's report on housing and racial inequality, a Brandeis University study highlighted homeownership as the number one driver of the growing racial wealth gap.

How many studies need to be published before policymakers begin treating housing like a human right and not a commodity to be gambled with on Wall Street? Perhaps more importantly, what must be done to unite and galvanize communities—of all races and classes—to push lawmakers and to take control of the situation where they're falling short? Inequality has become worse than most people think. Economic apartheid has gripped our country. But, money is no match for people power.

Learn more about what's happening on the ground with State of the Dream 2013: A Long Way From Home.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments