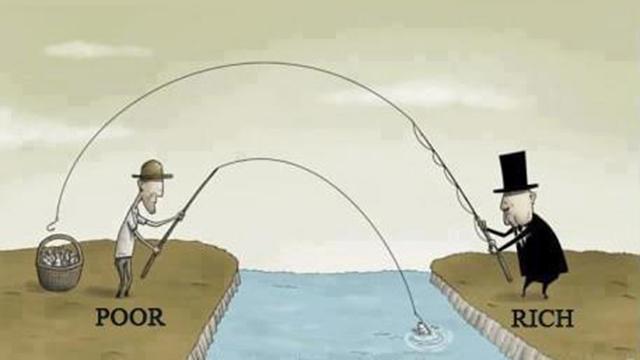

Oh, are we getting ripped off. And now we've got the data to prove it. From 2009 to 2011, the richest 8 million families (the top 7%) on average saw their wealth rise from $1.7 million to $2.5 million each. Meanwhile the rest of us — the bottom 93% (that's 111 million families) — suffered on average a decline of $6,000 each.

Do the math and you'll discover that the top 7% gained a whopping $5.6 trillion in net worth (assets minus liabilities) while the rest of lost $669 billion. Their wealth went up by 28% while ours went down by 4 percent.

It's as if the entire economic recovery is going into the pockets of the rich. And that's no accident. Here's why.

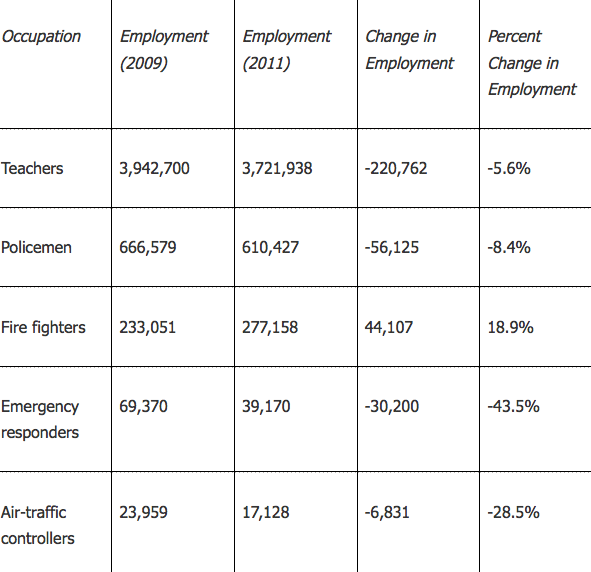

1.The bailouts went to Wall Street, not to Main Street.

The federal government and Federal Reserve poured trillions of dollars into Wall Street through a wide variety of financial maneuvers, many of which were hidden from view until recently. When we add it all up, it's clear that most of the money floated right into Wall Street. (Fannie and Freddie were private institutions that also considered themselves part of the Wall Street elite.)

2.Wall Street is Washington, Washington is Wall Street.

Those who shuttle back and forth between Washington and Wall Street designed the basic policies that both led to the crash and that responded to it. Hank Paulson, Bush's Secretary of the Treasury, served as chairman of Goldman Sachs before going to Washington. Timothy Geithner, Obama's Secretary of the Treasury, headed the regional Federal Reserve Board in New York (a board composed of Wall Street's Who's Who) before joining the Obama cabinet.

Countless government officials and congressional staffers can't wait to leave public service for lucrative jobs on Wall Street. Their collective mindset is that the world can't function properly unless the richest of the rich get richer. Any and all policies should therefore protect our biggest banks, rather than hinder them. And, of course, both parties are in hot pursuit of Wall Street campaign cash. Little wonder the so-called "recovery" transferred wealth from us to them.

3.The Federal Reserve banks on trickledown.

The Federal Reserve's ongoing stimulus policy comes down to this: The goal is to reduce interest rates on bonds of all kinds so that money flows into stocks. The more money that goes into the stock market, the higher go the stocks. Rising stock prices leads to what economists call the wealth effect — those who see their stocks rise dramatically feel richer and spend more. That's supposed to trickle down to the rest of us: The rich spend more, businesses recover and then, maybe, hire more people. It's working beautifully for the super-rich but obviously not for the rest of us.

But wait, don't most of us own stocks either directly or through our pension funds and 401ks? Dream on, says this chart:

INSERT IMAGE HERE: INSERT.PNG

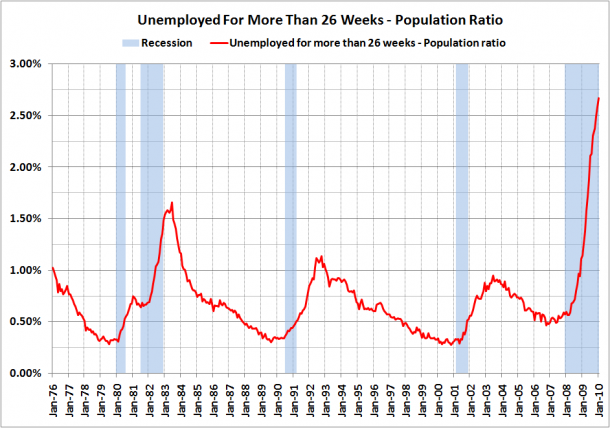

4.Washington fails to create enough jobs.

Wall Street's gambling spree tore a gaping hole to our economy. In a matter of months more than 8 million workers lost their jobs due to no fault of their own. What these elite financiers did to us is unconscionable, and they haven't had to pay a dime for the damage they caused. Although the stimulus programs prevented the slide from deepening, it was far too small to put America back to work. So now we're facing the highest levels of sustained unemployment since the Great Depression. The biggest victims of Wall Street greed are the long-term unemployed.

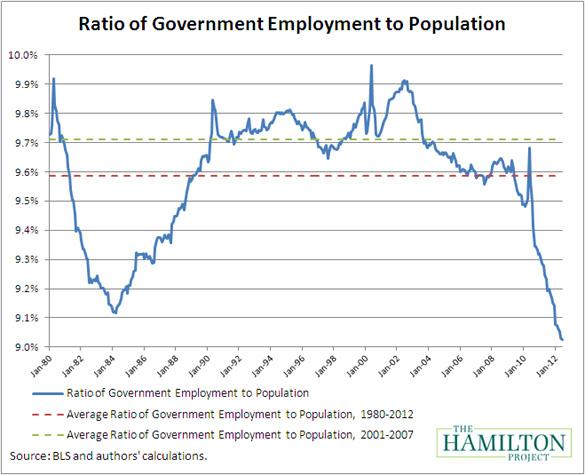

5.Government goes on a job-killing spree.

After Wall Street crashed the economy, businesses failed, workers lost their jobs and state and local tax revenues collapsed. In a just world, Wall Street would have been taxed to make up the difference. Instead, public employment was slashed. This further cut back on consumer demand, reduced tax revenues and then created pressure for another round of government job cuts. Of course, the Tea Party right loves the idea of crushing government jobs and public employee unions as well. But the main result is to increase unemployment, which in turn puts downward pressure on wages and increases profits for the wealthy.

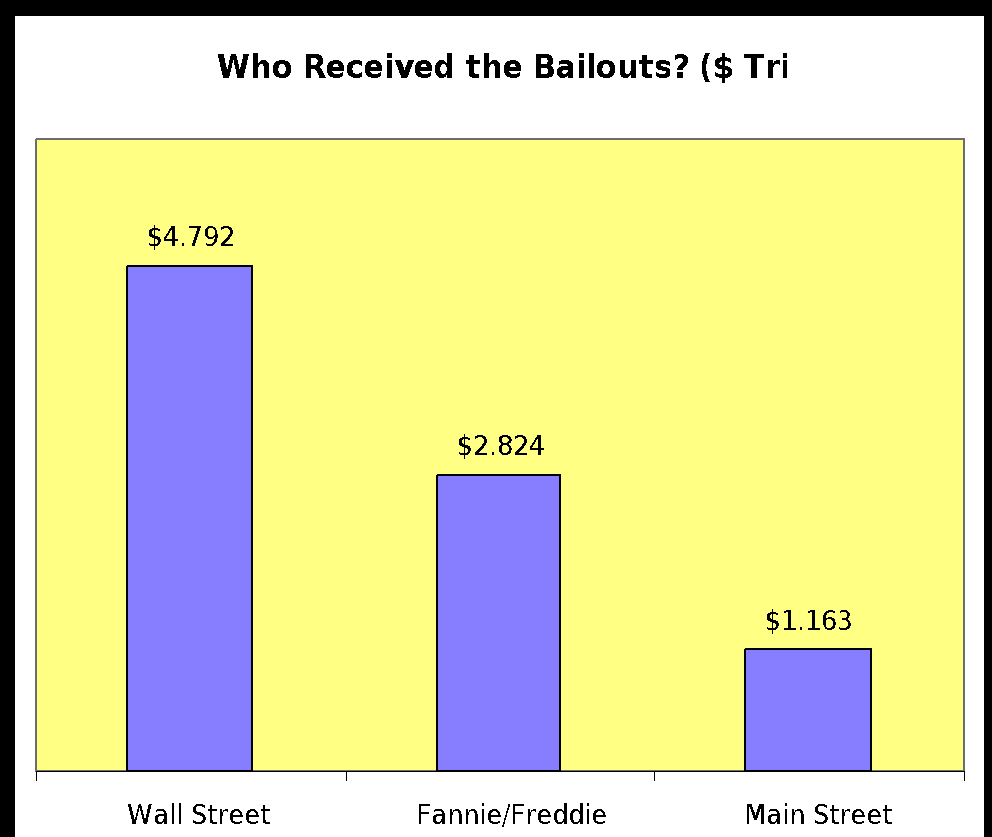

As Michael Greenstone and Adam Looney point out in "A Record Decline in Government Jobs: Implications for the Economy and America's Workforce", "we are in unchartered territory when it comes to government employment." The chart below from their Brookings article shows that among the major state and local job categories, only firefighters saw an increase.

INSERT IMAGE HERE: INSERT2.PNG

Overall, the combination of state, local and foolish federal cutbacks are collapsing public employment like never before. And again, whenever unemployment increases, it places downward pressure on the wages and reduces the wealth of the many, while the few are enriched.

6.The big banks have become even bigger criminal conspiracies.

Not only did we bail out too-big-to fail banks with public money and get nothing back in return, but Washington allowed them to grow even bigger. The biggest banks now have oligopoly power to rig prices. They also can illegally collude in order to siphon off more wealth from the rest of us. (For some juicy details, see Matt Taibbi's "Everything is Rigged: The Biggest Price-Fixing Scandal Ever." ) The corruption and cheating are reaching epic proportions as they gamble with insured deposit money, partner with loan sharks, money launder for drug cartels, and foreclose on homeowners who are up-to-date on their payments. All of that dirty money goes to the rich. (See "Are Big Banks Organized Criminal Conspiracies?")

7.Hedge funds run wild.

In 2012, the top hedge fund manager "earned" in one hour as much as the average family makes in 21 years. The top 10 hedge fund managers made as much in one year as 196,000 registered nurses. What exactly do these hedge fund honchos do? Much of it comes from what normal people call cheating — some of it legal, some of it borderline, and much of it criminal. But they're hard to catch. They profit from illegal insider tips, high-frequency trading, rumor-mongering, front-running trades, special tax loopholes and even by creating financial products that are designed to fail so that they can collect the insurance. They have their hands in our pockets 24/7. (See "America's New Math: 1 Wall Street Hour = 21 Years of Hard Work For the Rest of Us.")

8.The rise of the Ayn Rand Right.

The Tea Party brought a new viciousness to the national dialogue. Not only do they hate the government, but also, they hate the poor. Using the twisted logic of Ayn Rand, they see the world divided into winners and losers — and screw the losers. Not only do they oppose social programs like Social Security and Medicare, they also don't believe that government should work on behalf of the collective good. In fact, they see any and all collective efforts as an affront to personal liberty. They want a world where the creators rule and the moochers suffer. They would rather the rich rob us blind, than have the government try to stop the financial cheating and deception. If Wall Street destroys your job — too bad. Go get another one and don't expect the government to help.

9.The silencing of Occupy Wall Street.

For a few short months, the hundreds of Occupy Wall Street encampments dramatically shifted the national debate. Wall Street was in the crosshairs and "We are the 99 percent" spread into our consciousness. It's still there, but Occupy Wall Street isn't...at least not in the potent form that shook the rich and powerful. We don't have time here to discuss whether it was silenced by repressive authorities, or if it primarily caved in due to internal weaknesses in strategy and tactics. But this much is certain: a mass movement to take on Wall Street makes a difference.

The solutions are simple, but the fight is hard.

The Robin Hood Tax

The best way to move money from Wall Street to Main street is through a financial transaction tax — a small charge on each and every sale of stocks, bonds and derivatives of all kinds. Consider it a sin tax on Wall Street's many vices. Such a tax could raise enough money so that every student in this country could go to a two- or four-year public college or university, tuition-free Just think what the elimination of increasing student debt would do to the lopsided wealth statistics. Just think of what that would do for jobs as colleges expanded to deal with the demand. It's not a wild-eyed demand: 11 countries are about to adopt such a tax.

Public State Banks

A second critical strategy to end Wall Street as we know it is to form 50 public state banks on the model of the Bank of North Dakota. These would function as real banks rather than the rigged casinos that pass for banks on Wall Street. State banks are designed to support community banks that, in turn, lend to local businesses. Most importantly, the public bankers would be paid reasonable salaries rather than gouging themselves at the trough. (See "Why is Socialism doing so darn well in Deep Red North Dakota?")

The Public Banking Institute is paving the way as its leaders (Ellen Brown and Marc Armstrong) help some 20 states explore the idea. They need and deserve our support. And for all you Fed haters, they also are formulating some very cool ideas about how to dramatically transform our central bank. (More on that in a future piece.) Most importantly, we all need to find a common way to protest Wall Street's rule over the economy and over Washington. This isn't about redistributing their wealth. It's about getting ours back.

Originally published by AlterNet.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments