Among companies listed on the S&P 500, almost one in nine paid an effective tax rate of zero percent — or even lower — over the past year, according to an analysis by USA Today.

There are 57 separate companies listed on the index that paid a zero percent rate from the past year. Those companies include both household names like Verizon and News Corp. and lesser-known corporate giants like the data storage manufacturer Seagate (market value $15.9 billion) and Public Storage (market value $29.5 billion).

Many of the companies USA Today identified in its analysis as paying negative rates make the list because they lost money, but several were profitable. Previous analyses have shown that the typical corporation pays a lower effective tax rate than most middle-class families, and a far lower one than the statutory corporate tax rate against which business interests disingenuously rail.

Getting to a zero percent tax rate despite turning a profit requires creative accounting, but not lawbreaking. The corporate tax code allows companies to avoid tax liability even in years when they turn a profit. Some of the profitable companies on the newspaper’s list, such as General Motors, achieved a zero percent rate by banking tax credits from previous years when business was bad.

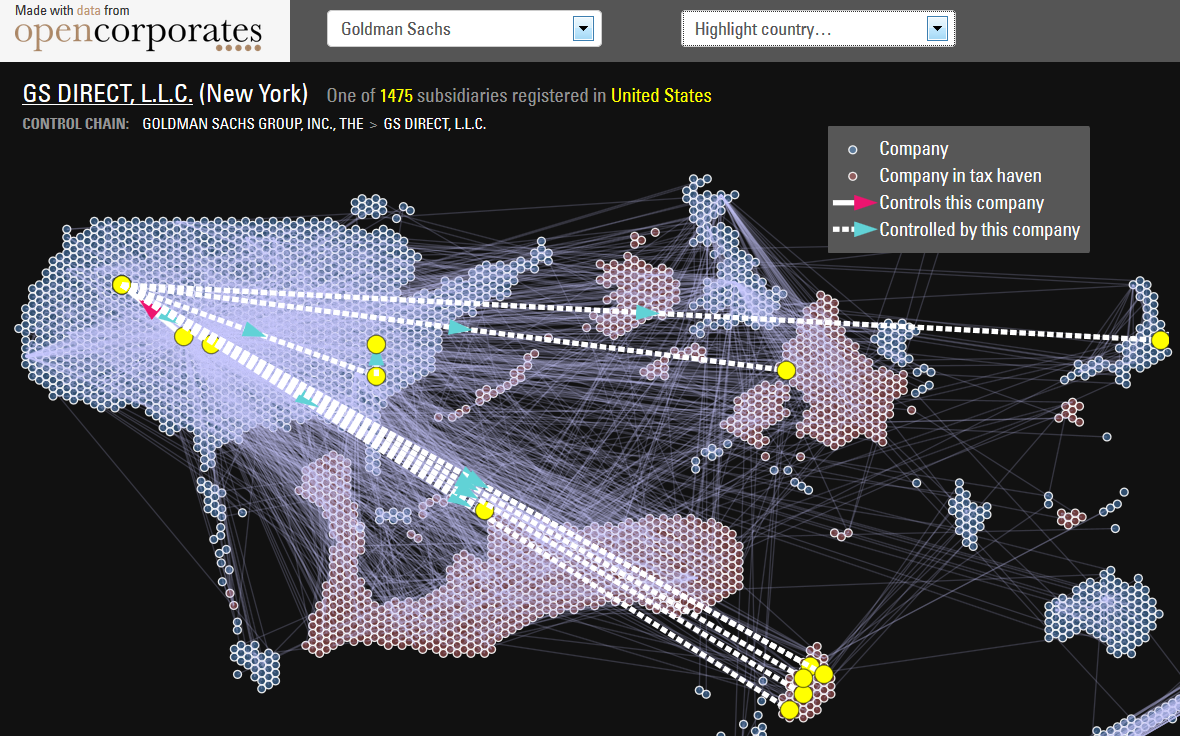

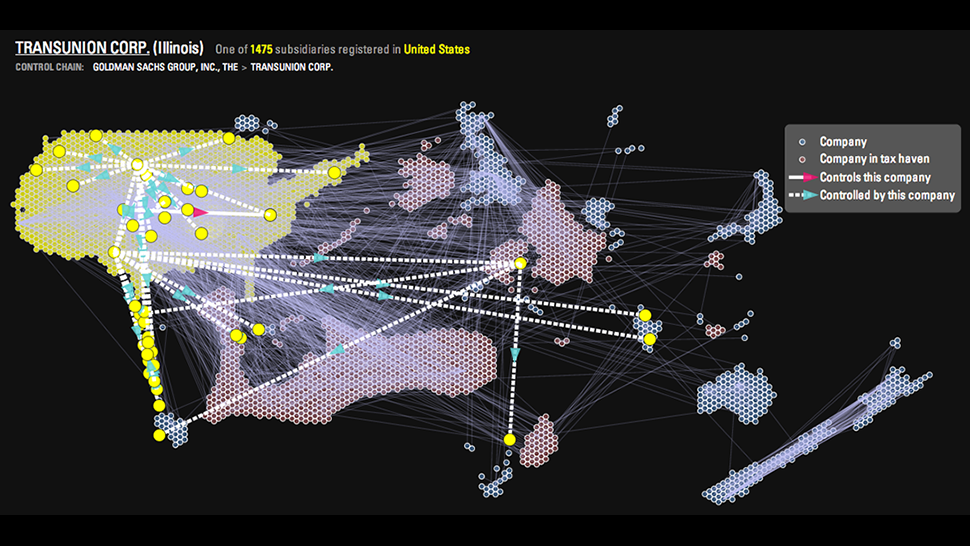

But the more common gambit involves moving revenues from parent companies to offshore subsidiaries based in tax haven countries in the Caribbean, Europe, and elsewhere.

Such offshoring of profits has caught the attention of policymakers in the United States and Europe this year, with the focus predominantly on Apple Inc. The U.S. tech giant not only avoided the American tax system, but managed to shelter about $100 billion in revenues from any taxes at all. That scheme relied upon a loophole in Irish law which that country’s government says it intends to fix, but the narrow change proposed by Ireland’s finance minister will not address the larger problem of corporate tax avoidance.

Tax dodging costs the U.S. about $300 billion per year. Much of that lost revenue is from individuals, rather than corporations. The country is cracking down on individual tax dodgers and striking deals with countries such as Switzerland and the Cayman Islandsthat will help identify tax cheats starting in 2014.

The corporate tax avoidance problem is thornier, as it is generally done through entirely legal methods. Coordinating international tax law in a way that would minimize corporate tax trickery is very difficult under the current approach, and a paradigm shift in business tax law may be necessary to end the accounting practices that rob countries of tax revenue.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments