President-elect Donald Trump isn’t just appointing incompetent buffoons to his Cabinet, but deeply immoral individuals who are completely lacking in family values.

Citizens for Tax Justice

Follow:

-

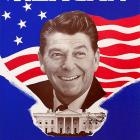

College Would Be Free In America If Corporations Paid Reagan-Era Taxes

Big businesses paid an effective tax rate of nearly 32 percent during Reagan’s eight years in office, but under Obama they have enjoyed paying just 22.8 percent – the average annual difference coming out to around $166 billion in corporate profit.

-

Bernie Targets Top 10 Corporate Tax Dodgers On Eve Of Iowa Primary

Sanders pledged Friday to close loopholes that allow Fortune 500 companies to exploit offshore tax havens, which last year enabled them to avoid paying U.S. taxes on over $2.1 trillion in accumulated profits.

-

Five Hypocrisies Shine A Light On American "Exceptionalism"

Super-patriots are more than willing to overlook their own faults as they place themselves above other people – the only question may be which of their self-serving hypocrisies is most outrageous and destructive.

-

10 Corporate Tax Dodgers and Their Tax Loopholes

A new report looks at 10 U.S. corporations that used an array of tax loopholes and corporate subsidies to slash their tax bills.

-

"Look away, America!": The Corporate Bait and Switch

The rich count on Americans being so distracted that they don’t focus on record corporate profits and offshore accounts.

-

Corporate Tax Betrayal: Ripping off the Public and Running with the Profits

Multinational corporations built their businesses on the backs of American taxpayers by depending on government research, national defense, the legal and educational systems and our infrastructure.

-

Facebook Paid No Corporate Income Tax Last Year After Making More Than $1 Billion

Between 2008 and 2011, 26 major corporations were able to pay no federal corporate income tax.

-

Top 10 Tax-Dodging Hypocrites

Time to name and shame the 10 worst tax-dodging hypocrites in America.