Biden cared more about the appearance of having an independent DOJ untainted by politics than he did about holding an unrepentant criminal ex-president accountable.

Volcker Rule

Follow:

-

An Invitation to Crisis: Loosening the Volcker Rule, Regulators Court Disaster

This is how financial crises begin – with subtle, incremental regulatory changes that few notice when they occur but which can have calamitous consequences when taken to their logical extreme.

-

Another Bad Idea: Regulators Chip Away at the Volcker Rule

By revising the Volcker Rule, a centerpiece of the 2010 Dodd-Frank act, the feds are pushing financial regulation in a direction that should worry everyone.

-

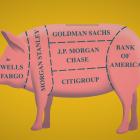

Why the Only Answer is to Break Up the Biggest Wall Street Banks

If the Fed's latest proposal to water down the Volcker Rule goes through, we’ll be nearly back to where we were before the crash of 2008.

-

Paving Way for Next Taxpayer-Funded Wall Street Bailout, Trump Fed Unveils Plan to Gut Volcker Rule

Ripping apart the central piece of Dodd-Frank will unleash a torrent of gambling by big banks and dramatically heighten the risk of another financial meltdown.

-

Here We Go Again: Ignoring History, Congress Moves to Loosen the Reins on Wall Street

The great trick of Wall Street and its apologists is convincing the people it burned last time they were let off the leash that this time they’ll behave better, swear to God.

-

How Congress Plans To Kill Dodd-Frank And Keep Wall Street Unregulated

Eager to relax the nation’s already accommodating financial regulations, lawmakers have a clear plan: seize on complex and esoteric financial activities that few understand, then make tweaks to regulations which wind up gutting them.

-

Post-Occupied: Where Are We Now?

Occupy did not happen in a vacuum, and any attempt to analyze it in one will fail. What happens next depends on how prepared people are to choose a direction, and how ready they are to push.

-

How Occupy the S.E.C. has Impacted the Volcker Rule, Fueling Insitutional Support

In terms of historical comparisons, Occupy the S.E.C. reminds me of various elements of populism that the United States experienced at the end of the 19th and beginning of the 20th centuries.

-

Volcker Rule Approved By All 5 Regulators Signals Crackdown on Wall Street Banks

The 953-page edict, part of the 2010 Dodd-Frank financial overhaul, codifies and restricts the way banks trade securities, setting in motion a broad new government rule to limit risk-taking by Wall Street and scale back trading activities.

-

Glass-Steagall Now: Because the Banks Own Washington

The original Glass Steagall created two distinct types of banks: standard commercial banks where people held checking and savings accounts, and investment banks that were free to engage in whatever risky behavior they liked.