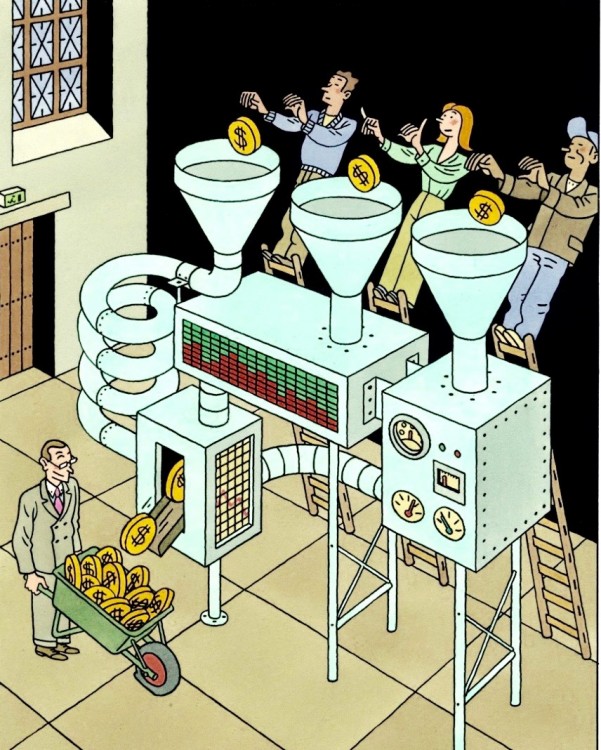

Cities, counties, and states are all hemorrhaging hundreds of billions, and possibly even trillions of dollars a year in banking fees. The root cause of this extortion has been ignored, until now.

The Public Banking Institute’s (PBI) What Wall Street Costs America project is shining light on the fact that fees paid to private Wall Street banks simply for managing accounts for state and local tax dollars is bankrupting communities across the country. The combined total for all 50 states may be as high as $4 trillion. PBI has launched a crowdfunding campaign to find the true cost of what private Wall Street banks really cost in major cities in all 50 states:

“The latest banking collapse cost people their lives, their homes, their educations, their futures. What we have been seeing is that Wall Street extracts hundreds of billions of dollars of our taxpayer money used for our public needs. That’s not necessary,” PBI board chair Walt McRee told US Uncut. “We don’t need to borrow their money for public needs.”

“Everybody’s pretty much had it with Wall Street. We know how they operate, and we’re sick of it. If we don’t take a stand, nothing will change. So much of our money is just going into private hands,” McRee added.

What Wall Street Costs One State in Banking Fees

In New Jersey alone, approximately $701 million in fees went to Wall Street banks just in 2015. These fees are similar to the fee an average person would pay to have a checking account at, say, Bank of America or JPMorgan & Chase.

In 2005, the Garden State created the New Jersey State Investment Council, which was tasked with diversifying the state’s pension fund. According to Banking on New Jersey coordinator Joan Bartl, what was once a $10 million cost in banking fees in 2005 ballooned to $600 million in 2014, and $701 million in 2015.

“New Jersey is $170 billion in debt. The State Pension Plan is underfunded by $113.1 billion. There is a proposal to cut benefits to state employees by $2 billion this year,” Bartl told US Uncut. “It is obvious that this $701 million could go towards mitigating these cuts to state employees.”

Aside from the exorbitant fees charged for simply managing public money, Wall Street traps states like New Jersey into expensive schemes to invest public money in high-risk financial instruments like interest rate swaps. In late 2015, it was revealed that New Jersey paid $720 million over a 5-year period to get out of a complex financial gambling scam that Wall Streeters convinced municipalities would be a sure bet.

“Private management of public funds has driven New Jersey further into debt, allowed scandalous political contributions from hedge fund dealers, exposed the state to risky investments, and caused loss of control of how the money is invested,” Bartl said.

Assuming Bartl’s estimates are correct, the Garden State spent $1.3 billion over a two-year period on account management fees alone. That figure is nearly equal to the $1.6 billion Governor Chris Christie cut from public K-12 and higher education in 2015.

Putting Money Back in the Hands of the People

Bartl and McRee are proposing that rather than pay astronomical fees to private Wall Street banks to manage tax revenue accounts, cities and states should instead charter public banks. The concept of a state-run bank isn’t just a socialist pipe dream either — North Dakota has the nation’s sole public bank, and despite the state voting for Republican presidents for 70 of the last 75 years, and nearly 35 straight years of Republican governors, there hasn’t been any successful effort to privatize the Bank of North Dakota (BND).

Through a partnership with 80 community banks across the state, the BND grants loans for public infrastructure projects, like building new roads, repairing city infrastructure, and school construction, all at low-cost interest rates. BND also offers student loans at a 1.5 percent interest rate. And as a public bank, the BND doesn’t engage in the same Wall Street gambling schemes that are bankrupting New Jersey, like interest rate swaps. Because of that, the BND will never need a bailout from the taxpayers.

As PBI founder and Web of Debt author Ellen Brown explains, the BND’s profits go right back to the state, since the bank is publicly-owned:

"Over the last 21 years, the BND has generated almost $1 billion in profit and returned nearly $400 million to the state’s general fund, where it is available to support education and other public services while reducing the tax burden on residents and businesses… The partnership of a state-owned bank with local community banks is a proven alternative for maintaining the viability of local credit and banking services. Other states would do well to follow North Dakota’s lead, not only to protect their local communities and local banks, but to bolster their revenues, escape Washington’s noose, and provide a bail-in-proof depository for their public funds."

“Wall Street is America’s biggest predator of our common wealth and public resources,” McRee said. “About 50 percent of the costs we pay for infrastructure, for example, go to private financing that we could do ourselves if we had our own public interest banks. But that just scratches the surface of the whole debt-service regime that our local and state governments are obliged to use.”

“A Criminal Cartel of Private Finance”

Through the What Wall Street Costs America project, PBI hopes to create enough public awareness and outrage by creating an interactive platform where people can not only see how much their state is paying in private banking fees, but learn how the bleeding out of public revenues is starving communities of the money needed to provide basic services — in some cash-strapped communities, schools are even asking students to bring their own toilet paper to school.

“These costs are far from just monetary,” McRee told US Uncut. “This campaign intends to show Americans there’s an option to the criminal cartel of private finance that preys on the public purse.”

Should their crowdfunding campaign prove successful, PBI will conduct detailed research on the most populous cities and counties across the country to find out just how many trillions of tax dollars are being siphoned into Wall Street’s coffers through banking fees. The project will also showcase the human side of the story, and feature the stories of community members beleaguered by the pillaging of the commons. The campaign, which is currently coordinated by an army of volunteers, aims to raise $100,000 to fund every aspect of the undertaking.

“What Wall Street Costs America is a people-produced, people-funded project that pushes back against the private money interests that have siphoned-off our common wealth, and it will begin new public initiatives across the country to reclaim control of public dollars for the public interest,” McRee said.

“The big banks want to sell us our own money, we say let’s create our own.”

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments