This is the first in a new series of stories, called “From the Ground Up,” chronicling community-level efforts to overcome economic insecurity and establish sustainable and just communities. A joint project of Occupy.com and Commonomics USA, this series will feature individuals and groups around the United States taking power into their own hands in the service of others.

Dan Leibsohn has been concerned about economic injustice and insecurity for a very long time. “I have tried to address issues of social justice in all of my work throughout my adult life,” says Leibsohn, founder of Community Development Finance, an Oakland-based nonprofit check-cashing store which also offers lending and money management. “I have focused mostly on access to capital for low income individuals and neighborhoods. Without adequate access to capital, neighborhoods, individuals, families, small businesses, organizations, nonprofits – they cannot fully succeed.”

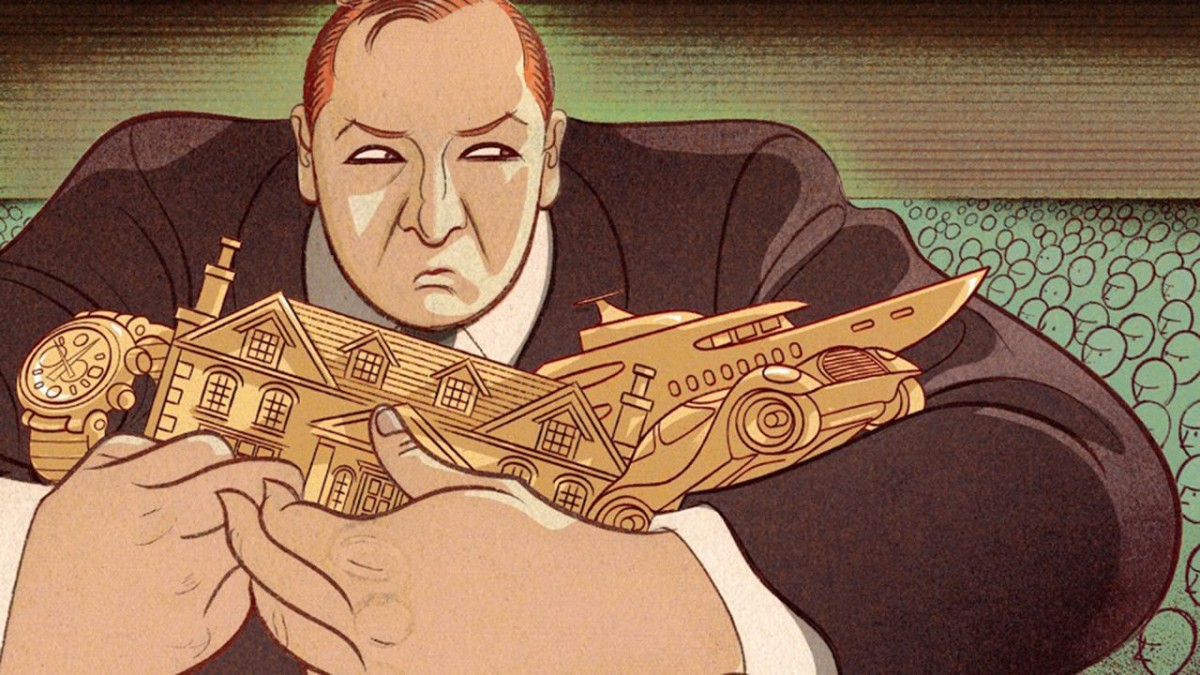

Dan is concerned with ending usury and financial exploitation by helping communities make money available for those who need it. He’s part of an age-old struggle. From the Vedic texts in ancient India in 1700 BC to the declarations of the last two Popes and the ongoing Islamic prohibition on charging interest, there has been a near-universal moral condemnation of usury. It’s not hard to see why: charging excessive amounts of money for the availability of credit or loans ruins communities, creating an upward flow of wealth while keeping the poor swimming in debt. Finance capitalists have no incentive to support economic policies that provide sustainability to the working class because such sustainability would decrease the need for poor people to borrow money.

In the U.S., the small-dollar loan industry is a $46 billion business. About 76% of the payday loan market is taken up by people taking out new loans to pay back old loans – a never-ending cycle of debt. The majority of loans are never paid back. Stephen Stetson of Arise Alabama recently told me that in Alabama there are 43,000 payday loans taken out every week, with interest sometimes as high as 455%. In Leibsohn’s state of California, over 12.4 million payday loans were made in 2014 – with interest and finance charges in the hundreds of millions of dollars.

All of this occurs against a larger context of widespread economic insecurity for Americans. Sixty-three percent of us can’t afford a $500 emergency. A third of us have no savings whatsoever. This isn't because we’re especially lazy or careless. Real wages have tanked, housing and medical costs have skyrocketed, and Wall Street has bled cities of public resources that used to help working people’s dollars go further.

Seeing these issues, and the inertia of any federal or state policies to address the root causes and symptoms of it, Leibsohn, who had previously founded and directed the Low-Income Income Housing Fund (now called the Low-Income Investment Fund), launched Community Development Finance (CDF) in 1998, and opened up the non-profit check-cashing store in 2009. Leibsohn knew that cities can’t just wish away predatory lenders: as bad as they are, they exist for a reason.

“They trap people in the debt cycle,” he told me. “They lobby to turn back efforts to change their businesses. They invent new ways to get around restrictive legislation. But people are choosing them for a reason – most banks and credit unions are just not interested in these customers. So options are limited. [Simply] eliminating payday loans would remove an important source of credit without replacing it with anything else.”

Leibsohn acknowledges that people sometimes make bad financial decisions. But he is quick to add that a lack of decent jobs, terrible trade policies and a “consumption society that pushes us to spend” all contextualize the spending habits of the economically insecure. After all, rich people make bad decisions, too. In order to change things for the better, Leibsohn knew that his model would need to listen to the needs of the economically insecure, offer them economic sustainability, and help them manage what little money they had – without violating their dignity or autonomy. It’s necessary, he says, to reinvent the perception of lenders and the financial community concerning risk, and the self-perception of the borrowers themselves.

The organization’s store, Community Check Cashing, offers below-market rates, minimal fees, financial consultation, and small business services. The store is operated on a “social enterprise model,” utilizing donations and grants to keep its services accessible and rates low. “The programs save customers an estimated $150,000 to $200,000 annually, or well over $1 million since we opened. This money stays with our customers,” Leibsohn says.

The biggest challenge is scale: the nonprofit business model for financial services can't work unless it grows, which is why, for example, the United States Post Office is uniquely suited to take on small-dollar loans or payday advances. CDF is currently seeking $500,000 in support to further develop its lending model. “We need nonprofits and public agencies to assist with access to their clients in need of loans,” Leibsohn says.

“We need the larger community to understand that check cashing and related products are not going away soon, to understand and accept that and to work with it. CDF has had four near-death experiences since 2012 – four times when we almost closed.”

I asked Leibsohn what single law he would change if he had the opportunity.

“Citizens United,” he answered, and “perhaps reinstate Glass-Steagall.” He is optimistic that at the local level, other organizations with mutual interests can benefit from the model offered by CDF. “We will try to work with any interested organizations within our financial and organizational limits in any way that fits their organizational and local needs.”

With the number of Americans who are economically insecure hovering over 60 percent and growing every day, and as capitalism continues to contract and the wealthy keep finding ways to hide their wealth, community-level solutions are essential – and so more Dan Leibsohns are essential.

Matt Stannard is Policy Director at Commonomics USA and a member of the Public Banking Institute’s Board of Directors.

If you liked what your reading and want to see more original reporting, please donate today!

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments

Comments

Michael Van Horn replied on

Occupy and Tea Party

The thing I keep seeing, and I wholly agree with the article especially about “Citizens United,” he answered, and “perhaps reinstate Glass-Steagall.” But, it is about usuary and banking... the Islamic financial system is more honest and works... the lender is a working partner and there is a finite amount of time before the borrower is free...

The biggest problem those that like the rhetoric of the "Liberal" side, such as occupy... don't realize that those that like the Rhetoric of the "Conservative" side such as the Tea Party... ARE SAYING the same thing... just describing two sides of the same coin. The Occupy are talking about keeping money in the community, the Tea Party is describing it in keeping more of what you earn... BOTH are looking for a solution to the injustice of it.

Michael