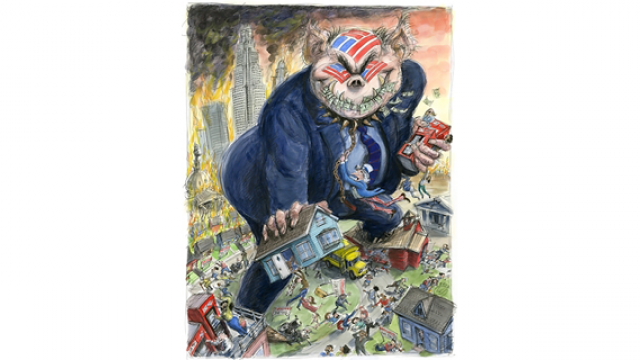

Photo: Illustration by Victor Juhasz for Rolling Stone

Bank of America — via the gravelly voice of Kiefer Sutherland — has referred to itself for the last few years as the "Bank of Opportunity." But in the midst of an economic civil war, they’ve dropped their advertising company – the propagandists that shifted BoA’s previous slogan from the laughable “Higher Standards” – and find themselves scrambling for a new market-friendly façade. Regardless of whatever branding the new spin-doctors come up with, Bank of America is proving itself to have zero standards – and all the opportunity a snowball faces in hell.

When Julian Assange announced that Wikileaks was planning to release records of “unethical practices" prevalent in an “ecosystem of corruption” surrounding a major U.S. financial institution, Bank of America was one of the first to respond – by refusing to service any donation made to the whistleblower organization. And their master plan for preparing for this massive leak of corporate wrongdoing? Buying up more than 450 internet domain names that might prove to be embarrassing to the bank or its CEO. Sad to say, friends, but BrianMoynihanSucks.com is taken. Their attempts to conceal the truth, however, only reveal the gravity of their situation – and ours.

The attorney general of Arizona, a state not known recently as a bastion of legislative tolerance, has criticized Bank of America’s attempts to obstruct investigations of their practices, noting that the bank has “repeatedly deceived” customers looking to lower their loan amounts. They’ve promised to fix the situation “by negotiating settlements with borrowers who must agree to keep them secret and not criticize the bank in exchange for cash payments and loan relief.” Court documents show desperate demands from BoA that borrowers “remove and delete any online statements regarding this dispute, including, without limitation, postings on Facebook, Twitter and similar websites.”

By demanding their customers keep their mouths shut in exchange for "fixing the problem," the bank seems to be taking a page out the Mafia's protection-racket handbook.

This isn’t the first time Bank of America has refused to cooperate with investigations into their mortgage practices either. The U.S. Department of Housing and Urban Development’s inspector general said in a lawsuit last year, “Our review was significantly hindered by Bank of America’s reluctance to allow us to interview employees or provide data and information in a timely manner.” That lawsuit was part of a damning HUD investigation that found all five of the nation’s largest mortgage companies defrauding taxpayers.

These multinational casino-capitalist banks aren’t content with exorbitant usury, with destroying entire neighborhoods of foreclosed homes, harassing the families of deceased customers – they’re trying to foreclose on people who never even had a mortgage, sucking funds out of needy schools and cities, and using your money to pay legislators to advance their agenda. Those employees who reveal the severity of the situation are hunted down like witches in 17th century Massachusetts. Matt Taibbi of Rolling Stone had it right when he wrote of Bank of America's excess, calling them an institution “too crooked to fail.” He joined a February Occupy Wall Street day of action to remind occupiers how shady Bank of America really is:

“This bank has systematically defrauded almost everyone with whom it has a significant business relationship, cheating investors, insurers, homeowners, shareholders, depositors, and the state. It is a giant, raging hurricane of theft and fraud, spinning its way through America and leaving a massive trail of wiped-out retirees and foreclosed-upon families in its wake.”

But Bank of America isn’t the only player in this high-stakes game of Monopoly; a culture of greed and corruption has permeated – even driven – each of the financial institutions that the government emphatically calls “too big to fail.”

Since greedy financiers at the major banks initiated an economic race to the bottom in 2008, they’ve been rewarded with massive bailouts, lucrative tax breaks and golden parachutes for fatcat executives, while workers lose jobs, retirement and homes. The toxic mix of political, economic and corporate interests has been the equivalent of financial terrorism perpetrated upon communities nationwide. Even before the crash, market fundamentalists allowed unchecked economic warfare to be waged, ravaging neighborhoods across wide swaths of the country. But the people – real people, not "corporate persons" – are fighting back.

November 5 was Bank Transfer Day, an Occupy-inspired day-of-action in which thousands of people around the country moved their money from the banking behemoths and into consumer-owned credit unions. While it is difficult to pin numbers down to grassroots initiatives like this, the month found credit unions adding 650,000 new members (normally around 80,000 in a regular month), resulting in more than $4.5 billion in new deposits. The reaction from the corporate banking establishment was shocking, even to those who hadn’t been paying attention: customers fed up with bad business were locked inside banks and faced arrest when trying to close their accounts.

Individual actions are a necessary component of any meaningful change in a broken financial system. But even more heartening is when entire communities have come together to pull their money out of corporate clutches. The city of Norman, Oklahoma, has done just that.

Not surprisingly, mainstream media outlets gave almost no coverage of the move; the local papers only made the briefest of obligatory mentions. But for members of Occupy Norman and concerned community leaders, the change is a real difference in the third-largest city in Oklahoma.

“Banks that are ‘too big to fail’ are too big to exist!” says Mary Francis, a fiery sixty-something activist from Norman. “Local banks and credit unions make more loans to local businesses than big Wall Street banks and they reinvest in the community. The obscene profits of huge corporations such as Bank of America or Wal-Mart do not get circulated in the local community. It’s only the local banks who have had a history of participating and donating to community events and charities.”

What started as an investigation of how the city used funds became a months-long campaign to get Norman to divest its money from Wall Street and bring it home. Occupiers first approached the City Council in December with concerns about illegal and risky gambling with community funds; by April, the Occupy Norman Direct Action Committee’s “Move Our Money” campaign reached its apex after in-depth editorials, research into local banks and credit unions and discussion with community leaders.

In a unanimous vote, the Norman City Council voted to terminate its contract with Bank of America and move all financial services to Bank of Oklahoma, a Tulsa-based institution. Grant DeLozier, a member of the Norman group, reminded Bank of Oklahoma – and the Council – that although the bank has thus far been free from the kinds of controversy and malfeasance that have plagued the larger institutions, they would not be getting a free pass. He pledged the group’s effort in keeping them honest. More banks need that reminder.

Norman City Council member Tom Kovach posted to Occupy Norman’s Facebook page after the vote, thanking local activists for using community pressure and proactive research to get accomplished what couldn’t be done through normal legislative channels.

"I first mentioned the Bank of America problem to the City after the financial meltdown and BoA was on the brink of insolvency," Kovach wrote. "No one wanted to make the move. It took the efforts of a dedicated group to make the change happen. Last night alone, several Occupy members waited five and a half hours to support this move. But it is the continuous efforts and the professional and respectful manner the whole group conveys that creates the impact necessary to make this advancement. Great thanks to all of you."

Occupy Norman’s actions are part of a groundswell of public outrage with the big multinational banksters over their role in the country’s financial and foreclosure crises. And although the approximately $250 million-dollar move represents only a small bite out of Bank of America’s bottom line, it hits them in the only way that capitalists understand. The withdrawals, like the May Day demonstrations, are a visible sign of the seething anger in the working class; they bring communities together, uniting disparate groups in common cause. Councilman Kovach reminds:

“We can bridge gaps and must to achieve positive change. Preaching to the converted only keeps things alive; to grow and make change, we must go beyond our comfort zones and listen to and work with unusual allies.”

The movement to divest from seemingly monolithic banking institutions continues to progress as cities join individuals, unions and churches in demanding accountability from Wall Street.

Philadelphia and Cleveland have already instituted a Community Reinvestment Act and dedicated activists have stormed the New York City Banking Commission to demand one. Other major metropolitan areas like Boston and Los Angeles have considered or passed laws known as “responsible banking ordinances” that require banks who want to do business submit detailed plans that outline how they’ll reach the needs of low-income and working-class residents.

These are all important steps to take to safeguard against poverty pimps seeking to bankrupt American dreamers. But isolated efforts at reform like this are not enough; when contemporary political realities reveal supranational financial institutions lording over governments – the banker-technocrat coup d'état in Greece and Italy, the austerity measures demanded in Spain and England, and so forth – only a revolution of values will create any meaningful change.

The global uprising has to be more than just a demand on a worldwide Ponzi scheme; we must demand an end to an entire system of oppression and coercion.

Why do we allow an economic minority – those who fatten themselves on capitalism's largesse – to own the collective efforts of billions? Why do we accept a media stranglehold by nine megacorporations, genetically-bastardized pseudo-food from Monsanto and ConAgra, a stripping of worker's rights won over the last century? Why do we allow politicians from both the Republican and Democratic wings of the corporate party to turn womens' bodies into political battlefields? A continuous state of emergency, eradication of fundamental principles of democracy, privatization of the commons?

What to think – the questions we ask – isn't nearly as important as how we think. Capitalism is a pervasive ideology; to deny its recuperative mechanisms requires interrupting the spectacle of the status quo – and acting in those liberated spaces, both physical and mental. The answer to some of these questions may already be well-known; getting to the substance of the question and actualizing the answer requires more. It requires a leap of faith.

Philosopher Simon Critchley writes in Adbusters that a “perfect storm” is brewing amongst disaffected youth, something “at once exciting and frightening”:

“What is so inspiring about the various social movements that we all too glibly call the Arab Spring, is their courageous determination to reclaim autonomy and political self-determination. The demands of the protesters in Tahrir Square and elsewhere are actually very classical: they refuse to live in authoritarian dictatorships propped up to serve interests of Western capital, megacorporations and corrupt local elites. […] The various movements in North Africa and the Middle East aim at one thing, one ancient Greek concept: autonomy.”

It is up to us to determine if this storm will rage enough to sweep away the accumulated dross of cancer-stage capitalism - or if our actions remain a tempest in a teapot.

Dr. Zakk Flash is an anarchist political writer, radical community activist, and editor of the Central Oklahoma Black/Red Alliance (COBRA). He lives in Norman, Oklahoma.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments