SAN FRANCISCO, Calif. – In the early morning hours, Solomon rises from bed and makes his way from Daly City, a San Francisco suburb, into the city. He has a 7am shift at Panda Express in the financial district. For five hours he works the food line, mixing sauces with chicken, beef and tofu for a quick Chinese-American meal. He makes minimum wage, and when his shift ends he quickly gets on a bus where he sits for almost an hour to make it to his next gig at an upscale restaurant in the Peninsula.

“It is tough days, but if I want to save any money and get my life in order, I have to work two jobs constantly just to cover rent, bills and put something away for next month,” he said. Ten-hour days are common for Solomon, who has moved from minimum wage job to minimum wage job over the past few years as he attempts to save money and enroll in technical training to become a security guard in the city, where he would earn $26 an hour.

“It is what I want to do, but the training program costs a lot of money and I just can’t afford it on one job,” he admitted.

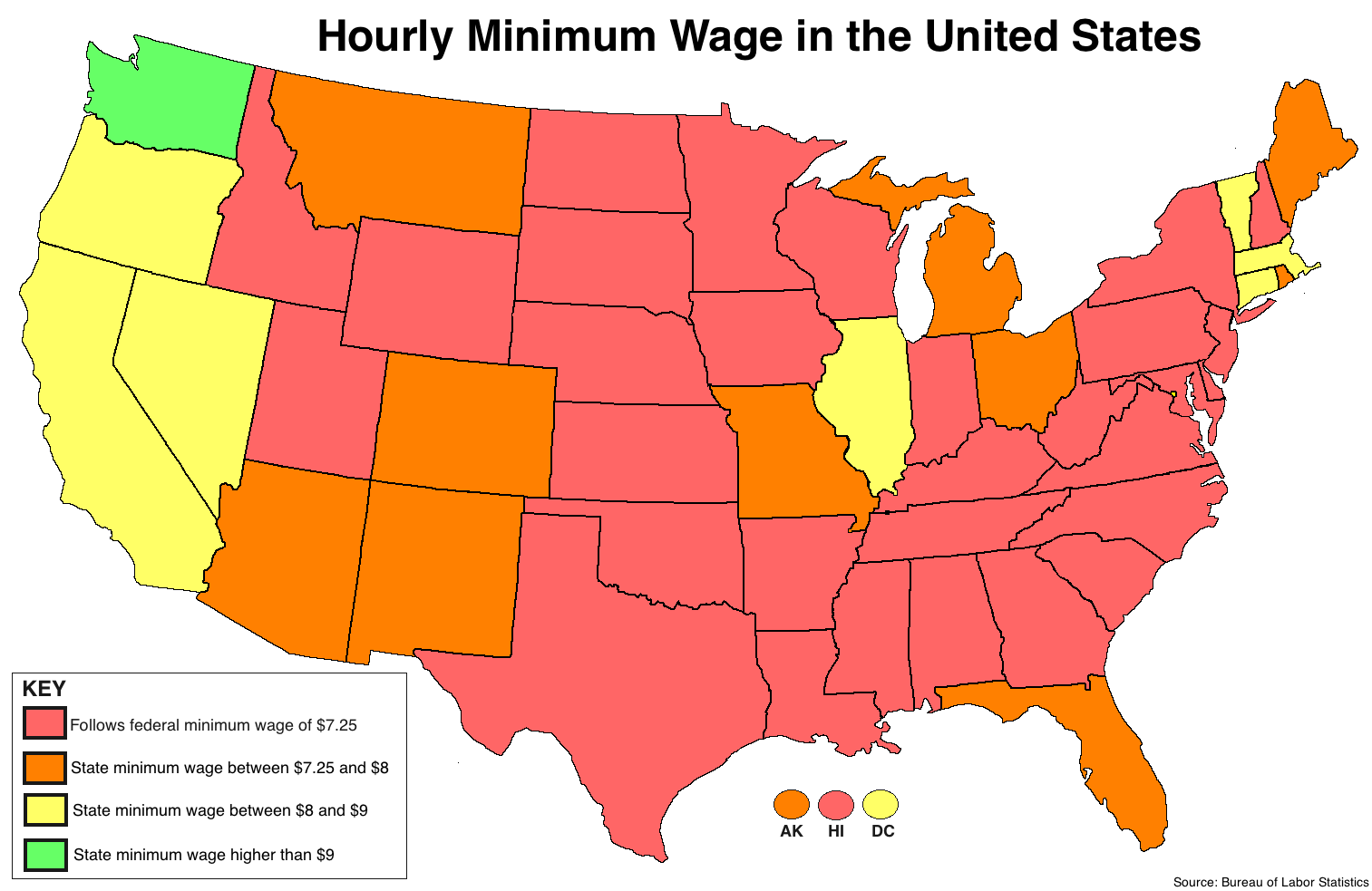

In September, California passed legislation to raise the minimum wage in the state to $10 an hour by 2016. The bill generated controversy and antagonized the restaurant industry especially. "This is the time to raise the minimum wage to provide relief for hard-working families," said the bill's author, Assemblyman Luis Alejo (D-Watsonville), commenting that about three out of five minimum-wage earners in the state are 26 or older.

Labor unions lobbied heavily for the bill, both in the legislature and at the governor's office. Business groups opposed it, and leading the charge were restaurant owners and their general managers who argued that raising the minimum wage would hurt their business and injure the workforce.

A director of a Bay Area restaurant and café chain, who preferred not to be named, admitted better living wages are needed, but argued the increase in the minimum wage would do more harm than good for those who work in the restaurant business.

“It is a tough business today, and to increase by a dollar next year the minimum wage will put workers in danger of losing their jobs, because we won’t be able to afford the increase,” he told Occupy.com in what has become an oft-discussed argument by business owners who oppose a higher minimum wage. The restaurant director said instead the state should consider allowing restaurants to pay servers even less than minimum wage – like the majority of American states – in order to cover costs.

“I have a hard time paying people more when they don’t claim all their earnings," he added. "It doesn’t seem fair that a server at a top restaurant is making some $30 an hour and not claiming it all, while someone at McDonald’s or WalMart is being forced to claim everything.”

But economists suggest there is no evidence that an increase in minimum wage at restaurants hurts business. In a number of recent studies, including one conducted by Harvard University economists, a cost increase of only $0.10 to $0.25 on the most popular menu items could offset worries by employers that a raised minimum wage would adversely affect business.

And customers, from fast-food chains to upscale fine-dining, seem more and more willing to pay for the wage increases. California’s labor unions pointed to these findings, arguing that the fear-mongering of business owners doesn’t fit the facts.

“We are a state that is forward-thinking and full of promise, and this wage increase will help to ensure that we can help get many people out of poverty and begin to really have good lives. It is the right step at the right time,” said John Iglatius, a Filipino labor economist and strategist who has worked for better labor rights over the past three decades in the Bay Area.

For Solomon and so many like him, the potential impact of a wage increase needs no explaining.

“I work about 60 hours a week on average, so to increase my hourly rate by a dollar would be huge. It means I will be bringing home at least another $200 a month most likely, and that will go a long way for me,” Solomon said.

But with California's business community continuing to push a campaign of fear over higher wages across the state, the coming increase may meet new challenges — especially if restaurant owners' fears are realized in the form of layoffs.

“I don’t know what we will do at this point, but I wouldn’t be surprised to see a number of restaurants forced to cut back a few workers here and there," argued the Bay Area restaurant director. "If that happens, I could see a major change in policy.”

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments