Part III in a three-part series about the Network of Global Control Control.

Corporate profits are good, right? Low taxes on corporations are also good, right? With high profits and low taxes, corporations have large amounts of money to "invest" in new businesses and jobs, meaning everyone else benefits. This is what we are told by politicians, it is what the majority of economists are taught to think, and it's what corporate executives and their spokespeople say constantly so therefore it must be true...right?

Let's get a reality check.

With record-breaking profits and record-low taxes, the truth is that corporations around the world have been hoarding record-high amounts of cash while finding legal loopholes to pay less, or none, of their taxes.

Holding trillions of dollars in cash would, in theory, allow corporations to invest in new businesses and create jobs: the old promise of trickle down economics. Instead, corporations have decided to firmly hold on to their cash, perhaps in preparation for the next financial crisis (which their refusal to invest in new opportunities and jobs is helping to create).

Or perhaps the executives are only waiting for our standards of living to decline far enough that austerity and "adjustment" policies produce desirable “investment environments” like those in existence across the "Third World," where unhindered corporate plundering and exploitation is the norm.

In 2010, Apple recorded roughly $13 billion in foreign profits but paid a negligible $130 million in taxes, par for the course for giant corporations. The result of Apple and other multinationals getting away with tax loopholes means disastrous consequences for governments. Google, for example, is able to move its billions in profits out of Europe, paying almost no taxes there as it deposits the revenues into the company’s administrative headquarters in Bermuda, where there is no corporate income tax.

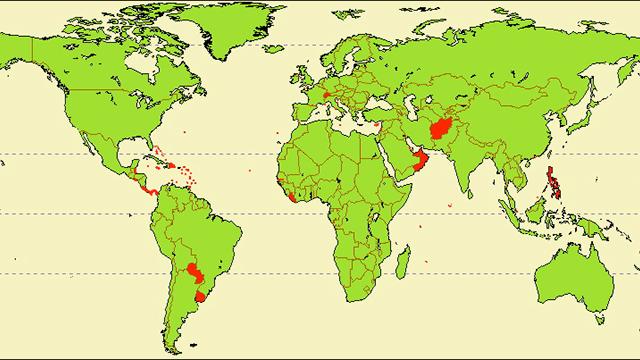

Tax havens and loopholes allow corporations to move around globally, creating a problem for national governments that seek to tax corporations at higher rates by establishing a "race to the bottom" in competition for reduced corporate taxes. Belgium, for example, with one of the highest corporate tax rates in the world, at roughly 34%, collects far less from companies due to its own tax loopholes.

The average tax rate for the 50 most profitable companies in Belgium – which totaled some 27 billion euros in profits in 2010 – was a mere 1.04%. Thus, as the government considers establishing a “minimum tax rate” of 12.5% to ensure revenue for the debt-ridden country, others fear that establishing such a rule would simply lead to corporations leaving the country and migrating to other tax havens across Europe.

As reported in Der Spiegel, “[a]n international treaty could prevent corporations from outsmarting countries,” however, “so far not even the European Union has been able to harmonize the rules of its member states.” Obviously, such an endeavor is not high on the priority list for European and international decision makers, which is hardly surprising since their main interest is in serving global corporations and banks.

At the same time that reports emerged last fall about major European and international corporations avoiding taxes, the Wall Street Journal wrote in November of 2012 that the continent’s biggest banks were “continuing to stash more money at central banks” rather than investing it, hoarding a combined total of $1.43 trillion in cash on reserve at several central banks.

Since 2010, the major banks have increased their cash hoarding by 84%. French bank Société Générale reportedly held 81 billion euros ($103 billion) at central banks in the third quarter of 2012.

This hoarding frenzy is happening even as banks across Europe continue to receive national and international bailouts, while demanding that countries further impoverish their populations through austerity measures so as to pay back their bad debts. This is a year after the European Central Bank provided 1 trillion euros to the continent’s banks in short-term cheap loans, supposedly “to jump-start lending to the businesses, individuals and other financial institutions.”

As the Wall Street Journal stated bluntly: “Across Europe, corporations are sitting on a mountain of cash.” Despite their massive reserves of cash, major corporations aren’t spending, and thus “one possible way out of Europe’s economic crisis – a big boost in business investment – is closed off.” According to the Institute of International Finance, the principle international banking lobby, this is common practice across most “mature and emerging economies.” Collectively, corporations in the United States, the Eurozone, the U.K. and Japan held roughly $7.75 trillion in cash, “an unprecedented sum.”

The Centre for European Reform, a think tank in London, reported that the ratio of investment to gross domestic product is at a 60-year low as corporations hoard more cash than ever before -- money which, in theory, could facilitate investment. In the Eurozone, corporate cash hoarding reached roughly 2 trillion euros (or $2.64 trillion). Meanwhile, austerity policies in European countries has led to a predictable retraction of growth, which in turn has led to more corporate hoarding.

Moving over to the U.S., it was reported in 2011 that corporations there had been hoarding cash to a larger degree than at any time in nearly half a century, with non-financial companies holding more than $2 trillion by the end of June 2011. This figure only acknowledged domestic cash hoarding by U.S. corporations, and didn’t include their foreign earnings. According to released IRS documents in 2009, major corporations, which held $1.7 trillion in cash from domestic operations, held a total of $5.13 trillion when including foreign cash assets.

As recently as 2008, the Government Accountability Office reported that despite trillions in earnings for corporations, the majority of U.S. and foreign-based corporations doing business in the United States managed to avoid paying any income taxes, with 72% of foreign and 57% of U.S. conglomerates successfully avoiding paying income tax for at least one year between 1998 and 2005.

Between 2008 and 2010, 30 large and profitable U.S. corporations paid no income taxes, even though the U.S. corporate tax rate was officially 35%. Among the companies that avoided paying any taxes were General Electric, PG&E and Boeing. Congress and state governments have encouraged the establishment of “pass-throughs,” allowing corporations to avoid paying any taxes by “passing” the profits along to investors.

This has been an exception given to businesses for decades, though the percentage of nontaxable corporations has rapidly grown, from 24% in 1986 to 69% in 2008, allowing private-equity giants like Blackstone Group and construction firms like Bechtel Group to avoid paying any taxes on their revenue.

In 2011, despite the 35% tax rate for corporations, the ten largest corporations in the United States paid an average federal tax rate of 9%, including companies like Exxon Mobil, Apple, Microsoft, JP Morgan Chase, and General Electric. Not surprisingly, the eight corporations that spent the most money on lobbying had lower tax rates, including Exxon Mobil, Verizon, GE, AT&T, Altria, Amgen, Northrop Grumman, and Boeing.

In 2010, when General Electric recorded worldwide profits of $14.2 billion, with $5.1 billion coming from operations within the United States, the company – one of the largest in the world – managed to pay no taxes at all, and, in fact, claimed a tax benefit of $3.2 billion. Between 2008 and 2011, 280 of the largest publicly traded American corporations paid an average tax rate of 18.5% on their profits, just slightly over half of what the actual tax rate is and less than most of their competitors in foreign industrialized countries.

Canadian companies have also been hoarding mountains of cash, not to be left on the sidelines by their American and Europe-based counterparts. In fact, it was reported that Canada’s corporations had hoarded more than half a trillion dollars in cash reserves, about $525 billion, by the end of 2011. This amounted to almost a third of the size of the entire economy, with at least 45% of Canada’s biggest corporations hoarding cash instead of investing or creating jobs.

Cash hoarding also allows companies to avoid paying taxes, giving companies further reason to not invest. In the U.K., corporate cash hoarding amounted to roughly $1.2 trillion, about half the size of the British economy -- though small compared to the $5.1 trillion hoarded in the United States, an amount larger than the GDP of Germany. An analyst at Ernst & Young stated, “Until these companies stop stashing the cash and start increasing levels of investment and dividends, the economy will remain on the critical list.”

Over the previous 22 years, the biggest American banks created more than 10,000 subsidiaries around the world, “using legal structures to pay lower taxes and escape tighter regulation,” according to figures released from the Federal Reserve. JP Morgan Chase, the largest American lender, had 3,391 subsidiaries, followed closely by Goldman Sachs, Morgan Stanley, and Bank of America, each with over 2,000 subsidiaries. Citigroup maintained over 1,500 global subsidiaries.

Since the repeal of the Glass-Steagall Act in 1999 (which had been put in place in 1933 to avoid another Great Depression), the big banks got even bigger, with even the Federal Reserve admitting that the law’s repeal was the “main catalyst” for the growth in the size of banks, whose assets tripled since that time to $15 trillion.

The combined assets of the five largest banks in the United States in 2011 was roughly $8.5 trillion, equal to 56% of the U.S. economy, compared to five years earlier, before the financial crash, when the total assets of these banks equaled roughly 43% of the American economy. The five banks – JPMorgan Chase, Bank of America, Citigroup, Wells Fargo and Goldman Sachs – are twice as large now as they were ten years ago.

The facts are in. The reality is this:

Big banks, corporations, and powerful states created the global economic crisis for which the people of the world are forced to pay, and suffer, with declining wages, decreased opportunities, increased debt and expanding poverty. Meanwhile, those who created the crisis make record profits, pay little or no taxes, hoard trillions in cash, and fail to “invest” their revenues.

The question is now, what are we going to do about it?

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments