In this recent report for the Roosevelt Institute, Nobel Prize-winning economist Joseph E. Stiglitz suggests that paying our fair share of taxes and cracking down on corporate tax dodgers could be a cure for inequality and a faltering economy.

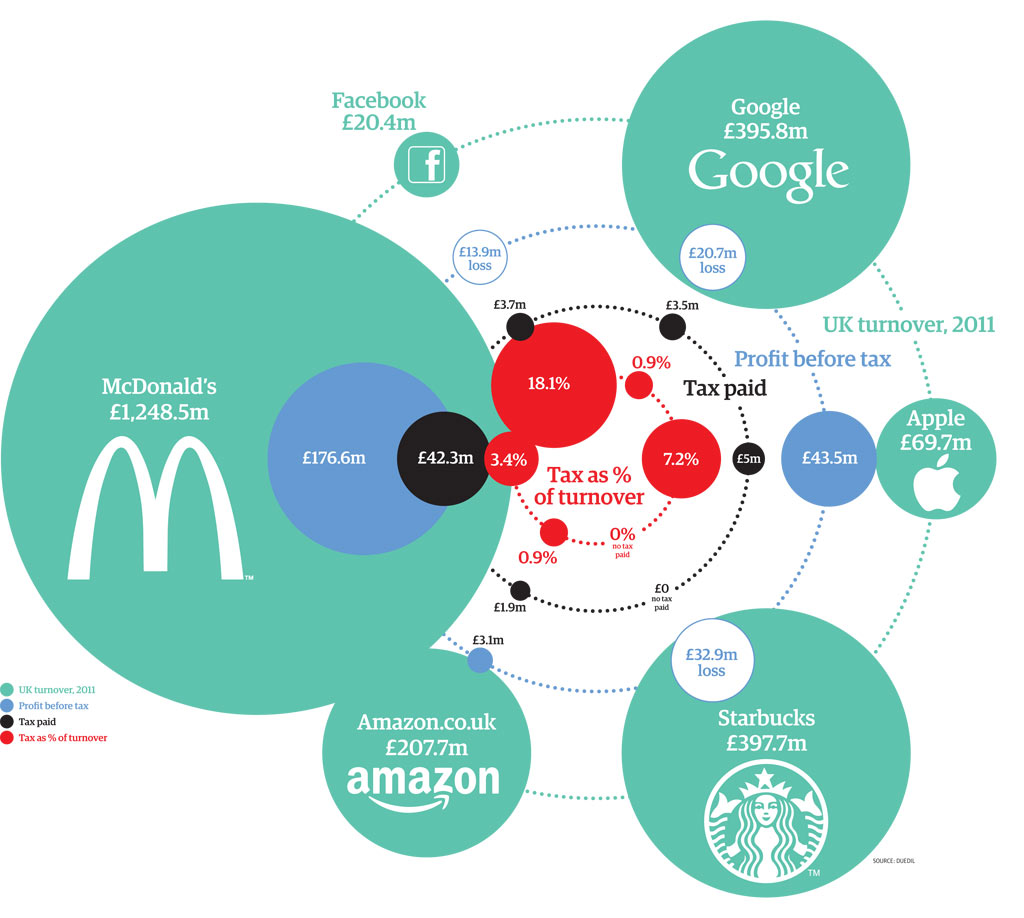

In the above video, Stiglitz tells Bill Moyers that Apple, Google, GE and a host of other Fortune 500 companies are creating what amounts to “an unlimited IRA for corporations.” The result? Vast amounts of lost revenue for our treasury and the exporting of much-needed jobs to other countries.

“I think we can use our tax system to create a better society, to be an expression of our true values,” Stiglitz says. “But if people don’t think that their tax system is fair, they’re not going to want to contribute. It’s going to be difficult to get them to pay. And, unfortunately, right now, our tax system is neither fair nor efficient.”

Stiglitz continues, “We have a tax system that reflects not the interest of the middle. We have a tax system that reflects the interest of the one percent… What I want to do is create a tax system that has incentives to create jobs. And if you tell a corporation, ‘Look, if you don’t create jobs, you’re taking out of our system, you’re not putting anything back, you’re going to pay a high tax. But if you put back into our system by investing, then you can get your tax rate down.’ That seems to me common sense, particularly in a time like today, when 20 million Americans need a full-time job and can’t get one.”

This recent report by Americans for Tax Fairness suggests that corporate taxes are near a 60-year low — and that’s partially because corporations have become adept at not paying their share.

Here’s a list of 10 tax-dodging corporations excerpted from the Americans for Tax Fairness report:

Bank of America runs its business through more than 300 offshore tax-haven subsidiaries. It reported $17.2 billion in accumulated offshore profits in 2012. It would owe $4.3 billion in U.S. taxes if these funds were brought back to the U.S.

Citigroup had $42.6 billion in foreign profits parked offshore in 2012 on which it paid no U.S. taxes. It reported that it would owe $11.5 billion if it brings these funds back to the U.S. A significant chunk is being held in tax-haven countries.

ExxonMobil had a three-year federal income tax rate of just 15 percent. This gave the company a tax subsidy worth $6.2 billion from 2010-2012. It had $43 billion in offshore profits at the end of 2012, on which it paid no U.S. taxes.

FedEx made $6 billion over the last three years and didn’t pay a dime in federal income taxes, in part because the tax code subsidized its purchase of new planes. This gave FedEx a huge tax subsidy worth $2.1 billion.

General Electric received a tax subsidy of nearly $29 billion over the last 11 years. While dodging paying its fair share of federal income taxes, GE pocketed $21.8 billion in taxpayer-funded contracts from Uncle Sam between 2006 and 2012.

Honeywell had profits of $5 billion from 2009 to 2012. Yet it paid only $50 million in federal income taxes for the period. Its tax rate was just 1 percent over the last four years. This gave it a huge tax subsidy worth $1.7 billion.

Merck had profits of $13.6 billion and paid $2.5 billion in federal income taxes from 2009 to 2012. While dodging its fair share of federal income taxes, it pocketed $8.7 billion in taxpayer-funded contracts from Uncle Sam between 2006 and 2012.

Microsoft saved $4.5 billion in federal income taxes from 2009 to 2011 by transferring profits to a subsidiary in the tax haven of Puerto Rico. It had $60.8 billion in profits stashed offshore in 2012 on which it paid no U.S. taxes.

Pfizer paid no U.S. income taxes from 2010 to 2012 while earning $43 billion worldwide. It did this in part by performing accounting acrobatics to shift its U.S. profits offshore. It received $2.2 billion in federal tax refunds.

Verizon made $19.3 billion in U.S. pretax profits from 2008 to 2012, yet didn’t pay any federal income taxes during the period. Instead, it got $535 million in tax rebates. Verizon’s effective federal income tax rate was negative 2.8 percent from 2008 to 2012.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments