In Chicago – where hunger strikers are protesting school closures, where school closures result from throwing public money into risky Wall Street ventures, where risky ventures happen under the nose of venture-capitalist-in-chief Rahm Emanuel – people want a financial transaction tax.

Lara Weber of the Chicago Tribune editorial board describes a recent town hall meeting in Chicago where the mayor attended. It was a budget meeting with 500 people, many of whom “took time to register for their allotted 60 seconds of microphone time and got their brief chance to address the mayor,” writes Weber, and asked “thoughtful questions about why the city’s red-light camera system is still in place, despite its deep flaws. They asked how the mayor intends to prioritize child care funding. They recommended that Emanuel pursue a financial transaction tax.”

The mayor, whose loyalties are clear, loathes the idea of a financial transaction tax for the same reason that Wall Street fears it – not because it would be especially cumbersome (read on), but because it represents a democratically-imposed limit on the financial class against doing whatever it wants with our money.

A financial transaction tax (FTT) is a tiny charge placed on financial (rather than consumer) transactions. It can range from a dime to fifty cents per $1,000 exchanged. Many countries have particular transaction taxes – Peru for foreign wire transfers, Finland for Finnish securities and derivatives, France for stock purchases of publicly traded French companies with a market value over €1 billion. Brazil used to have a financial transaction tax, then it didn’t, and now it wants one again.

Supporters of an FTT in the U.S. have been pushing the plan for years, though it’s not as alluring, loud or radical-sounding as public banks or worker-owned cooperatives. Experts on the tax tell me that global cooperation will make it work even better (money travels easily) and that we can start it anywhere – particularly in cities where financial trading is concentrated, like New York and Chicago.

I recently spoke with James Henry, an attorney, senior fellow at Columbia University’s Center for Sustainable International Investment, and an adviser to the Tax Justice Network. Henry says the financial transaction tax, which is designed to extract money from high-frequency trading – 68% of which is controlled by nine powerful banks, including some with criminal convictions – is a “positive project” for economic justice advocates. “Simple and intelligible,” an open-and-shut case.

Henry and other proponents say the tax would do two critical things to correct the imbalanced economy: slow money down, and spread it out.

The tax would limit the large-scale financial transactions that economists say are occurring far too quickly and creating the volatility that is again on display with the recent market plunge. As Maria Gallucci of the International Business Times describes it, the tax could “discourage the sudden sell-offs and volatile trading that are causing the Dow Jones Industrial Average’s wild swings,” since “computer-based trading accounts for roughly half today’s trade volume, exposing the markets to increasing instability.”

Henry adds: “This would be a tax on speed. Capitalism makes us crazy. We might as well collect something for it.” If the tax is as much a liquidity hindrance as its opponents claim it is, maybe it will slow down the “constant noise” of financial markets whose volatility hurts small investors and the general public, he says.

The other argument is that a transaction tax could generate much-needed redistributive revenue across America – money which, in the absence of more structural economic reform coming from government, could be used to pay for college tuition (like Bernie Sanders’s plan) or other services, or simply redistributed as a basic income or dividend.

“Tax proposals vary in size and target,” Gallucci writes. “But the Tax Policy Center, an independent think tank in Washington, estimates that a 0.01 percent excise tax, spread over trillions of transactions, could raise $185 billion over 10 years.”

That redistributive element is crucial. Although sometimes under-emphasized in alternative media coverage, the financial transaction tax carries near universal support among people on the deeper end of the economic justice movement. That’s because, while the financial transaction tax is still just a tax, it has tremendous breadth and potential for income generation at a time when we’re looking for sources of dividend distribution.

Recently, Kevin Zeese’s Popular Resistance newsletter pointed out that technology has outpaced the need for labor, and thus there “will never be enough jobs in the future so we need a new way to ensure people have money on which to live and to keep the economy going.” I asked Zeese whether he felt the transaction tax was still a hot issue for progressives and the economic justice movement.

“The case for the tax has gotten stronger since 2006 as the finance sector has become an even larger segment of the economy,” he answered. “Even a tiny, micro tax of under 1% on stocks, bonds, and derivatives would fund essentials for creating a more diverse economy,” including basic income, free education and money for new kinds of cooperative businesses.

Laura Wells, California's Green Party candidate for governor in 2010 and State Controller in 2014, agrees with the “practical benefits” of the tax. But Wells, organizer of the No Corporate Money Campaign, told me she also sees the tax's potential to reduce the concentration of wealth and “increase the power of ordinary people to make our own decisions on things that deeply affect us.”

My colleagues at Commonomics USA like it, too. Communications director Ira Dember told me he thought a transaction tax would “either make [big volatile] trading less profitable or unaffordable, essentially killing this toxic practice.” Our outreach coordinator Susan Harman, who is more convinced than ever that we’re dealing with pathological people punching numbers on a screen, told me: “Since most financial transactions these days merely build additions onto the Wall Street house of cards, anything that discourages that construction is helpful.”

Like other good ideas, Wall Street hates this one, and its minions will quickly move in to sap political will and encourage politicians to act against their constituents’ interests. Earlier this month, revelations emerged about the financial sector’s hold over several members of the Congressional Black Caucus, who are being wooed into helping kill regulations designed to force financial advisers to tell the truth and not give out sham advice to investors.

In the case of the financial transaction tax, opponents argue that it will “decrease liquidity” – a fancy way of saying that increasing the cost of transactions decreases the amount of money floating around in the system, making it harder to invest, spend cash or extend credit.

Well, yeah, James Henry replied when I asked him about this. “Liquidity is not always a good thing. The world is awash in capital,” he said. The problem is a lack of investment in productive assets, which is why states and municipalities need credit (for small businesses, public spending and the like). What the world doesn’t need are more high-level breakneck-speed financial transactions.

How do we garner the political will to win such a policy? Keep the base broad, Henry added, and you keep the tax low – ridiculously, unable-to-notice low. A one basis-point tax would amount to ten cents per thousand dollars. At that measurement, a hundred thousand dollar financial transaction would cost ten bucks to execute. “You could raise a hell of a lot of money no one would miss,” says Henry.

Jared Bernstein, senior fellow at the Center on Budget and Policy Priorities and a former economic adviser to Vice President Joe Biden, says that 75 percent of liability for an FTT would fall on the top 20% of Americans. He's skeptical of every argument against the tax. “If our financial markets will crumble in the face of a one-basis-point financial transaction tax,” Bernstein writes, “then we've got much bigger problems than I thought.”

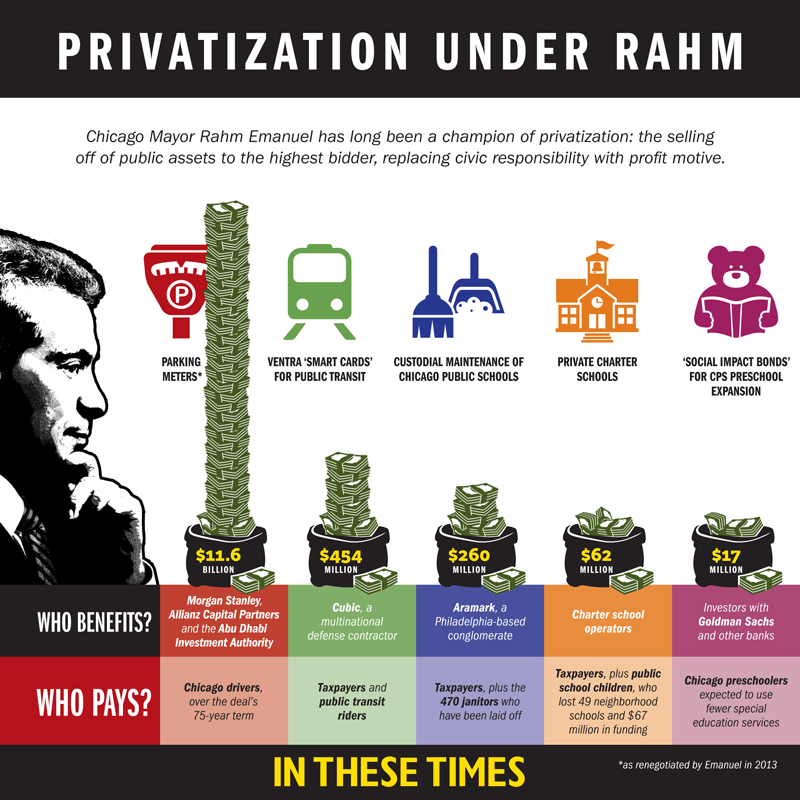

Wall Street’s opposition to the financial transaction tax is even more frustrating given how much its firms charge America’s municipalities for their financial transactions. It's come to light in recent months that Wall Streeters make municipalities pay millions, even billions, in interest for managing public money. They frequently do so in defiance of laws; both their illegal and legal deals have ruined many of our nation’s cities and left countless people in poverty, struggling in broken neighborhoods after water and other necessities have been privatized. Against that evidence, Wall Street’s resistance to a tax of a penny per hundred dollars only adds to its image of childishness and unwarranted audacity.

Matt Stannard is policy director at Commonomics USA and a Board Member of the Public Banking Institute.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments