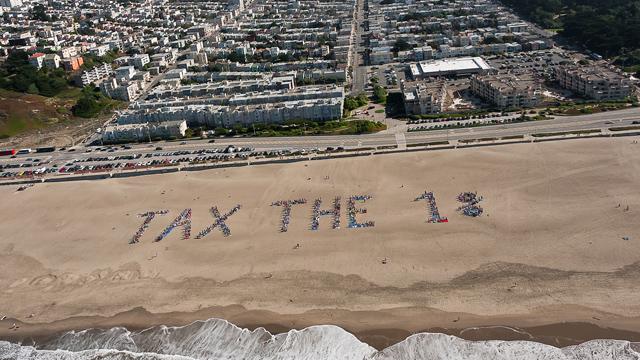

Photo: Human Banner SF.

Wealthy individuals and corporations want us to believe they've made it on their own, without the help of government or the American people. Billionaire financier Sanford Weill blustered, "We didn't rely on somebody else to build what we built." He was echoing the words of his famous predecessor, the formidable financier J.P. Morgan, who spouted, "I owe the public nothing."

That's the bull of Wall Street. There are at least five good reasons why the wealthiest Americans need government as much as the rest of us, and probably more.

1. Security

In his "People's History," Howard Zinn described colonial opposition to inequality in 1765:

"A shoemaker named Ebenezer Macintosh led a mob in destroying the house of a rich Boston merchant named Andrew Oliver. Two weeks later, the crowd turned to the home of Thomas Hutchinson, symbol of the rich elite who ruled the colonies in the name of England. They smashed up his house with axes, drank the wine in his wine cellar, and looted the house of its furniture and other objects. A report by colony officials to England said that this was part of a larger scheme in which the houses of fifteen rich people were to be destroyed, as part of 'a war of plunder, of general levelling and taking away the distinction of rich and poor.'"

That doesn't happen much anymore. Of course, the super-rich aren't taking any chances, with panic shelters and James Bond cars and personal surveillance drones. But the U.S. government will be helping them by spending $55 billion on Homeland Security next year, in addition to $673 billion for the military. The police, emergency services, and National Guard are trained to focus on crimes against wealth.

In the cities, business interests keep the police focused on the homeless and unemployed. And on drug users. A "Broken Windows" mentality, which promotes quick fixes of minor damage to discourage large-scale destruction, is being applied to human beings. Wealthy Americans can rest better at night knowing that the police are "stopping and frisking" in the streets of the poor neighborhoods.

2. Laws and Deregulations

The wealthiest Americans are the main beneficiaries of tax laws, property rights, zoning rules, patent and copyright provisions, trade pacts, antitrust legislation, and contract regulations. Tax loopholes allow them to store over $1 trillion in assets overseas.

Their companies benefit, despite any publicly voiced objections to regulatory agencies, from Small Business Administration and SEC guidelines that generally favor business, and from F.D.A. and U.S.D.A. quality control measures that minimize consumer complaints and product recalls.

The growing numbers of financial industry executives have profited from 30 years of deregulation, most notably the repeal of the Glass-Steagall Act. Lobbying by the financial industry has prolonged the absurdity of a zero sales tax on financial transactions.

Big advantages accrue for multinational corporations from trade agreements like NAFTA, with international disputes resolved by the business-friendly World Bank, International Monetary Fund and World Trade Organization. Federal judicial law protects our biggest companies from foreign infringement. The proposed Trans-Pacific Partnership would put governments around the world at the mercy of corporate decision-makers.

There are even anti-antitrust measures, such as the licensing rules that allow the American Medical Association to restrict the number of doctors in the U.S., thereby keeping doctor salaries artificially high. Can't have a free market if it hurts business.

3. Research and Infrastructure

A publicly supported communications infrastructure allows the richest 10% of Americans to manipulate their 80% share of the stock market. CEOs rely on roads and seaports and airports to ship their products, the F.A.A. and T.S.A. and Coast Guard and Department of Transportation to safeguard them, a nationwide energy grid to power their factories, and communications towers and satellites to conduct online business. Private jets use 16% of air traffic control resources while paying only 3% of the bill.

Perhaps most important to business, even as it focuses on short-term profits, is the long-term basic research that is largely conducted with government money. Especially for the tech industry. Taxpayer-funded research at the Defense Advanced Research Projects Agency (the Internet) and the National Science Foundation (the Digital Library Initiative) has laid a half-century foundation for technological product development. Well into the 1980s, as companies like Apple and Google and Microsoft and Oracle and Cisco profited from the fastest-growing product revolution in American history, the U.S. Government was still providing half the research funds. Even today 60% of university research is government-supported.

Public schools have helped to train the chemists, physicists, chip designers, programmers, engineers, production line workers, market analysts, and testers who create modern technological devices. They, in turn, can't succeed without public layers of medical support and security. All of them contribute to the final product.

As the super-rich ride in their military-designed armored cars to a financial center globally connected by public fiber optics networks to make a trade guided by publicly funded data mining and artificial intelligence software, they might stop and re-think the old Horatio Alger myth.

4. Subsidies

The traditional image of 'welfare' pales in comparison to corporate welfare and millionaire welfare. Whereas over 90% of Temporary Assistance for Needy Families goes to the elderly, the disabled, or working households, most of the annual $1.3 trillion in "tax expenditures" (tax subsidies from special deductions, exemptions, exclusions, credits, and loopholes) goes to the top quintile of taxpayers. One estimate is $250 billion a year just to the richest 1%.

Senator Tom Coburn's website reports that mortgage interest and rental expense deductions alone return almost $100 billion a year to millionaires.

The most profitable corporations get the biggest subsidies. The Federal Reserve provided more than $16 trillion in financial assistance to financial institutions and corporations. According toCitizens for Tax Justice, 280 profitable Fortune 500 companies, which together paid only half of the maximum 35 percent corporate tax rate, received $223 billion in tax subsidies.

Even the conservative Cato Institute admitted that the U.S. federal government spent $92 billion on corporate welfare during fiscal year 2006. Recipients included Boeing, Xerox, IBM, Motorola, Dow Chemical and General Electric.

In agriculture, most of the funding for commodity programs goes to large agribusiness corporations such as Archer Daniels Midland. For the oil industry, estimates of subsidy payments range from $10 to $50 billion per year.

5. Disaster Costs

Exxon spokesperson {Ken Cohen once said](http://www.nationofchange.org/who-takes-gold-tax-avoidance-2011-1333979061): "Any claim we don't pay taxes is absurd...ExxonMobil is a leading U.S. taxpayer." Added Chevron CEO John Watson: "The oil and gas industry pays their fair share in taxes." But SEC documents show that Exxon paid 2% in U.S. federal taxes from 2008 to 2010, Chevron 4.8%.

As if to double up on the insult, the petroleum industry readily takes public money for oil spills. Cleanups cost much more than the fines imposed on the companies. Government costs can run into the billions, or even tens of billions, of dollars.

Another disaster-prone industry is finance, from which came the encouraging words of Goldman Sachs chairman Lloyd Blankfein: "Everybody should be, frankly, happy...the financial system led us into the crisis and it will lead us out."

Estimates for bailout funds from the Treasury and the Federal Reserve range between $3 trillion and $5 trillion. That's enough to pay off both the deficit and next year's entitlement costs. All because of the irresponsibility of the super-salaried CEOs of our most profitable corporations.

Common Sense

Patriotic Millionaires recently addressed the President and Congress: "Given the dire state of our economy, it is absurd that one-quarter of all millionaires pay a lower tax rate than millions of working, middle-class American families...Please do the right thing for our country. Raise our taxes."

It's good to know somebody gets it right. Taxes, for the most part, are not unfair. They represent payment for society's many benefits, which get bigger and better as people get richer.

3 WAYS TO SHOW YOUR SUPPORT

- Log in to post comments